These five pieces got our gear columnist through a week of surviving off the bare minimum in the backcountry

The post The Gear I Used During a Backcountry Survival School in Utah appeared first on 国产吃瓜黑料 Online.

]]>

I just spent a week backpacking around Utah鈥檚 Dixie National Forest, learning a mix of primitive and modern survival skills while traversing terrain that ranged from sandy desert canyons to high-elevation pine and aspen forests. The survival gear I carried during this adventure was minimal. I made a lot of it during the trip, like a bow-drill fire kit and a piece of cloth we turned into a backpack. It was hard. Making fire when you鈥檙e cold isn鈥檛 easy. Shivering through the night without a sleeping bag is鈥ell, cold.

I did have some survival gear with me, though not everything I took into the wilderness performed well. My pants ripped, and a fleece jacket I brought collected so much debris that it was like wearing the forest on my back. Fortunately, a handful of items that I used throughout the week shined, making everything easier. Here are the key pieces of survival gear that helped me get through a week of backcountry survival school.

If you buy through our links, we may earn an affiliate commission. This supports our mission to get more people active and outside. Learn more.

Stetson Bozeman hat

I knew I needed a full-brimmed sun hat to keep the desert ball of fire off my face and neck, but I also knew the temperatures would range from the high 70s to the low 40s. I wanted something that could keep me warm during inclement weather, but not overheat my dome mid-day鈥攕o something straw wouldn’t work. Enter The Bozeman, which is made from 100 percent wool, so I knew it would breathe in the heat and keep me warm when the temperature dropped.

Even better, it鈥檚 part of Stetson鈥檚 Crushable hat series, which features stylish lids that can be packed away, sat on, shoved into a backpack, slept on, and they will reform back to their original shape. I abused this thing, even using it to pad my homemade backpack straps at one point, and the hat always popped back into shape when I needed it. Not only did it keep me from burning in the sun, but it鈥檚 naturally water resistant and worked as an umbrella, which kept my head dry during rain showers. The Bozeman gets the MVP of survival school award.

Pendleton Olympic National Park blanket听

About halfway through the week, us students 鈥渆arned鈥� a blanket, which we turned into backpacks during the day and became our sole source of warmth at night. I brought one of Pendleton鈥檚 National Park series of blankets, which are made from thick, pure virgin wool. You can pick your size, from twin to king, and I went with the full, which was a little heavy while carrying it throughout the day, but I didn鈥檛 complain about the extra fabric at night.

We slept exposed to the elements each night, and this blanket formed a cozy barrier that kept me perfectly warm until the sun came up. It was also easy to brush the debris off the fabric, which doesn’t sound important, but is actually a big deal when you鈥檙e rolling around in leaves, dirt, and sticks all night.

Sherpa 国产吃瓜黑料 Gear Kangtega sweater听

We were allowed one sweater during this adventure, and I went with this 100 percent merino wool layer that has been part of my ski kit for a few years. I chose it because I knew it had a great warmth to weight ratio and could handle moisture well. Good thing too, because it rained on us one afternoon as we were climbing to 9,000 feet. I slipped into this sweater to stay warm, and it dried completely before nightfall when I needed it to keep me warm as I slept. It also looks great, too. Just because you鈥檙e surviving in the desert doesn鈥檛 mean you can鈥檛 look cute.

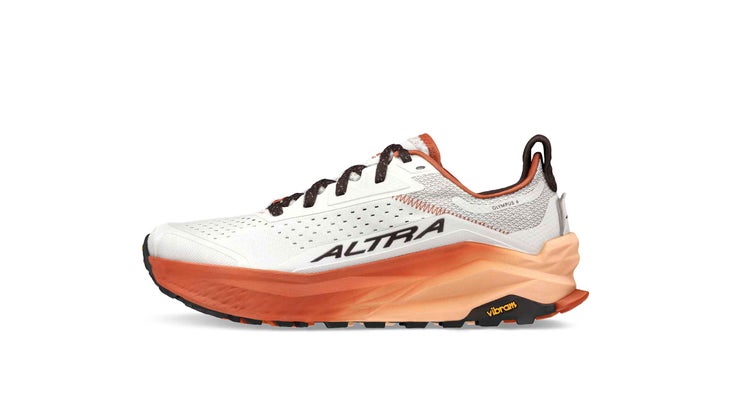

Altra Olympus 6 running shoe

I鈥檝e run in Altra鈥檚 Lone Peak sporadically in recent years, and I like the company鈥檚 take on the zero-drop shoe concept, which boils down to an even amount of cushioning throughout the footbed. When you compare that to other shoe companies that achieve zero drop by removing most, if not all of the cushion, it seems like a pretty smart choice. For this particular adventure, I knew I would be on my feet for several hours each day, so I wanted the most cushion possible, which led me to the Olympus 6.

The Olympus 6 is a zero-drop, max-cushion beast of a trail runner that many A.T. thru-hikers rely on for consistent comfort and performance. I hiked a variety of terrain, trudging through thick sand, scrambling down sandstone slot canyons, and jumping over creeks, and the Olympus handled it all like a champ. I appreciated the roomy toe box (my feet were definitely swelling towards the end of the week) as well as the cushioned cuff, which locked my heel in place while also keeping some of the sand out of my shoe. Most nights were so cold, I kept these shoes on my feet as I slept, and after seven days of constant hiking and wear, I exited the survival school without a single blister or hot spot.

Morakniv Companion knife听

I鈥檒l be honest, I originally packed a much more expensive fixed blade knife for this course. But one of my instructors convinced me to go with this much cheaper option because of its single edge blade, which makes carving wood more straight forward and is easier to sharpen by hand. I鈥檓 glad I switched. I wore this knife on my hip all week and used it to make a variety of tools, from an eating spoon to the hearth-wood at the center of my fire kit.

It鈥檚 a simple design: a 104-millimeter carbon steel blade is backed by a comfy, rubber grip, making it easy to wield. It can handle fine carving tasks (like fine-tuning the bowl of a spoon) as well as brute tasks like chopping firewood. The moral of this story? Just because a knife is cheap doesn鈥檛 mean it won鈥檛 perform.

The post The Gear I Used During a Backcountry Survival School in Utah appeared first on 国产吃瓜黑料 Online.

]]>

Our gear columnist refuses to wear anything but swim shorts in the warmer months. Is he just lazy, or is he on to something?

The post Why Our Gear Columnist Only Wears Swim Shorts Now appeared first on 国产吃瓜黑料 Online.

]]>

I only wear now. Like all the time. I wear them around my office, to run errands, and while walking the dog. I wear them to the gym and when I鈥檓 going out to dinner or meeting friends for happy hour. I wear them on casual bike rides and short runs. I鈥檓 wearing a pair of as I’m currently typing, and I鈥檒l stay in these shorts for the rest of the day until it鈥檚 time for bed.

I don’t wear swim trunks all the time because I鈥檓 a lifeguard or even an avid swimmer (I can鈥檛 remember the last time I went to the pool). I wear them because they鈥檙e the most comfortable shorts I own. Period. It鈥檚 the summer equivalent of wearing joggers every day during the winter.

Does this mean I鈥檝e given up on life and I鈥檓 sacrificing style for comfort? My wife and kids certainly think so. But I鈥檇 argue that all men should consider making the same sacrifice; Life is better once you realize a good pair of trunks is the only couture you need for summer.

First of all, these aren鈥檛 the swimsuits of my youth, which were uncomfortable things made from a semi-rigid poly that bordered on plastic, with no pockets and a weird mesh liner that felt like my junk was trapped in a fishing net. The swim trunks I鈥檓 wearing now are high-performance layers with four-way stretch outer shorts and a silky, smooth boxer brief liner that鈥檚 as comfortable as the finest skivvies in my underwear drawer. That boxer brief liner is stretchy and doesn鈥檛 bind whether I鈥檓 sitting at my desk or knocking out a 15-minute yoga sesh.

All of the swim shorts in my quiver are comfortable enough to nap in but built for performance, so they can handle a workout. And they all have hand pockets, as well as a rear pocket, so I can carry my essentials as I run errands. Put all those attributes together and you have the perfect layer for summer (especially considering the unbearable heat waves we’re all living through). Moisture management is more important than ever. Can you think of any layer that can handle moisture better than a pair of swimmies? No, you can鈥檛, because these shorts are literally designed to get soaked and dry fast.

The swim-suit-all-day-life isn鈥檛 all roses, though. My wife complains that I鈥檝e adopted the mindset of a grade-school-aged kid who wears his soccer uniform everyday. But that鈥檚 not true. I have different suits for different occasions. A flower print suit听 is great for when I think I might actually go swimming, or at least get into the hot tub or sauna. My camouflage suit is for when I鈥檓 feeling rugged, and a retro striped suit for evenings out. Plus, I鈥檇 argue that these shorts are stylish because they make a bold statement to the world. They say I鈥檓 a guy that鈥檚 up for whatever. Maybe I鈥檒l take a nap or knock out some lunges or I could jump on a paddle board and head down the river. Who knows where the day will take me, but I鈥檓 wearing the shorts to handle whatever situation arises.

Carpe Diem; that鈥檚 what wearing swim shorts every day says. Carpe Diem.

Here are three of my favorite pairs of swim trunks that I wear all day, every day, no matter what my wife and kids say.

If you buy through our links, we may earn an affiliate commission. This supports our mission to get more people active and outside. Learn more.

Saxx Go Coastal 2N1 shorts

I have a lot of pairs of Saxx underwear because they fit so well that I forget I鈥檓 wearing them. The Go Coastal takes that same sense of comfort to swim shorts with a soft boxer-brief liner that comes complete with Saxx鈥檚 signature Ballpark Pouch. It鈥檚 the softest liner I鈥檝e tested. The only downside to these shorts is the back pocket doesn鈥檛 have a zipper, but the liner comes with a sleeve perfectly sized for your phone, so there鈥檚 a storage solution for whatever you need to carry. The floral print on these shorts is fun, but my wife says they鈥檙e not 鈥渄inner appropriate.鈥�

Bn3th Agua Volley 2N1 Swim Shorts听

Speaking of heat waves (and global warming), everything in the Agua Volley is made from recycled materials, all the way down to the elastic waistband. The liner is thin and breathable and includes Bn3th鈥檚 3D Pouch, which offers the most structural support for the family jewels of any liner I鈥檝e tried. I have the longer, 7-inch inseam shorts because I have chicken legs, but you can go with the 5-inch if you like the short-shorts look. The outer shell doesn鈥檛 have as much stretch as the other options in this article, but the longer cut makes them more appropriate in situations where swim trunks might look out of place, like on a date.

Chubbies Lined Classics Shorts

The Chubbies Lined Classics are my favorite swimmers in my quiver. The outer short has a brushed, next-to-skin softness that you don鈥檛 often find in the category. Also, the pair I own has a retro-striped aesthetic that gives the shorts a stylish edge over the competition. Pair the Lined Classics with a boat shoe and a well-fitting polo shirt and you could convince people that you just stepped off your schooner.

The post Why Our Gear Columnist Only Wears Swim Shorts Now appeared first on 国产吃瓜黑料 Online.

]]>

Leverage the power of brick-and-mortar retail to give online customers a premium shopping experience

The post Your Untapped E-Commerce Secret Sauce for 2021: Local Gear Shops appeared first on 国产吃瓜黑料 Online.

]]>

Last year, in the face of the COVID-19 pandemic, e-commerce sales grew an unprecedented 24 percent globally compared to in-store sales, which decreased by 7 percent (Forbes). In-store performance likely would’ve slipped much more if it weren’t for fulfillment options like curbside and in-store pickup. Brands that were prepared to sell online mitigated some of the lost in-store sales, but because in-store sales still make up about 80 percent of total retail sales, many could not completely cover the loss with e-commerce.

E-commerce isn’t going anywhere. It’s expected to grow 13 percent in 2021 (Kiplinger), and it’s essential to continue to optimize the online shopping experience. Options like BOPIS (buy online, pickup in-store) and curbside pickup will stay in high demand. Consumers have grown very accustomed to these hybrid fulfillment options over the last year in particular. According to the National Retail Federation, “most consumers will be looking for local businesses that offer hybrid solutions.”

Utilizing Local Shops to Provide Incredible E-Commerce Experiences

Brick-and-mortar will make a big comeback in 2021 as vaccines are rolling out, and people are going to want to experience in-store shopping again. Kiplinger expects in-store sales to rise 7 percent in 2021. According to the National Retail Federation, consumers will flock to stores once it is deemed safe to shop. So how does a brand optimize its e-commerce experience while continuing to support the rebounding wholesale channel?

The answer is to offer in-store pickup and curbside fulfillment. These options meet consumers’ expectations while decreasing fulfillment time, reducing abandoned carts, driving store traffic, and ultimately increasing sales. It’s the secret sauce.

Why It’s Especially Vital for the Outdoor Industry

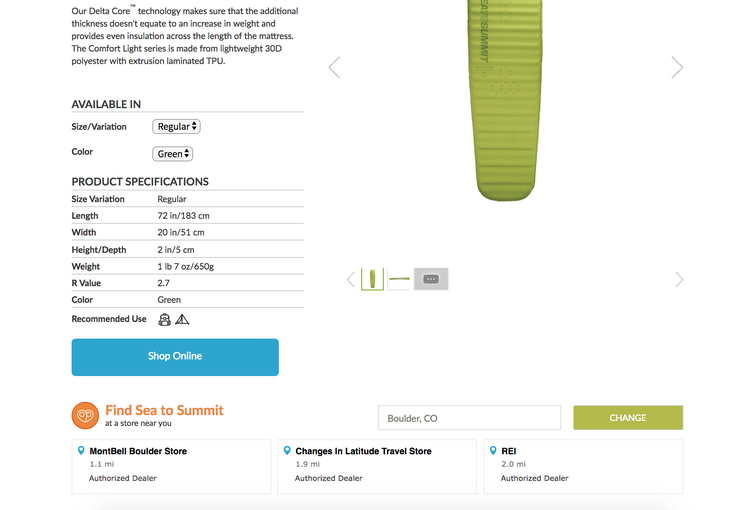

The outdoor industry is a tight-knit community. We rally around each other, our love for shared experiences, and we even nerd-out with each other about our gear. The shop experience is probably more important in the outdoor industry than in any other. Consumers want to talk with someone about gear, receive input and feedback, bounce ideas off someone, even receive beta on local trails. Outdoor industry consumers love their local shops, and with good reason.

These shops are also the places we go to try things on, to get our skis mounted, our boots fit, our bikes tuned up, our gear repaired, and so on. Products like yours benefit significantly from that in-person interaction and often require it. These are specialty products we’re talking about. Technical, complex, specialized gear that often requires some setup, fitment, or education around its use.

As the outdoor community returns to normalcy, outdoor consumers will be jonesing to get back into their local gear shops, certainly to buy gear, but also to socialize. Let’s be honest with ourselves鈥攖hat sounds pretty darn nice. It is vital as an outdoor brand to support the wholesale channel. Buy-online-pickup-in-store fulfillment is a great way to do that. It’s a fulfillment option that 68 percent of shoppers have used, and it’s how 50 percent of shoppers decide where to buy (RetailDive). Offering BOPIS helps capture latent demand on your website, reduce abandoned carts, and increase e-commerce sales, but it’s also a great way to help shops get consumers in the door, move product off shelves, and upsell.

As a specialty brand selling specialty products, you must have an e-commerce platform that can help you offer a premium, omni-channel shopping experience to consumers. Your customers shouldn’t have to choose between shopping online and in-person at a store. It should all work together harmoniously with the same goal: getting your specialty products into the hands of consumers in a timely, convenient, efficient manner.

The post Your Untapped E-Commerce Secret Sauce for 2021: Local Gear Shops appeared first on 国产吃瓜黑料 Online.

]]>

Everyone knows Amazon鈥攐r thinks they do. But most shoppers and even retailers misunderstand how this gargantuan marketplace really works. We deconstruct 8 common fallacies

The post Amazon Myths: Busted appeared first on 国产吃瓜黑料 Online.

]]>

It can feel like more rumors than facts swarm around Amazon, in part because the retailer is notoriously secretive鈥攁nd that makes it hard to separate truth from speculation. In most news articles that discuss the world鈥檚 largest retailer, experts point out, you won鈥檛 find any sources from within the company providing actual information. Consequently, consumers, retailers, and brands end up making their own assumptions鈥攎any of them false. Add in Amazon鈥檚 constantly evolving practices, and misconceptions abound. We tapped a panel of on-the-ground experts to set the record straight.

Meet the Amazon Experts

Mike Massey

The owner of New Orleans-based Massey鈥檚 Outfitters became one of the first specialty retailers to sell gear through Amazon when he opened a third-party shop in August 2004. In 2014, he launched Locally to connect online shoppers with local retailers.

Peter Kearns

For four years, Kearns worked on Amazon鈥檚 Seller Services team, where he helped hundreds of brands generate more than $500 million in sales. Then, Kearns spent the next four years as a consultant helping brands and retailers hone their Amazon strategy. He鈥檚 now VP of Business Development for 180Commerce, an Amazon brand strategy and management agency that specializes in the sports and outdoor industry.

Larry Plumier

Responsible for launching the outdoor category for Amazon Retail, Larry Pluimer worked at Amazon from 2008 to 2010. Now, he鈥檚 Founder/CEO of Indigitous, an Amazon services agency that provides brands with strategies and resources for Amazon advertising, catalog optimization, and vendor representation.

Myth 1: Amazon Is a Discounter First

Not anymore. 鈥淚n the early days, Amazon did lead on price,鈥� said Larry Pluimer, who remembers when it lowered prices to drive the traffic required to attract brands. Now, however, with nearly 200 million people visiting the site each month, Amazon has shifted its strategy to maintaining prices for maximum profits.

That鈥檚 the preference, anyway. But in practice, Amazon pursues low prices on the products it sells when it鈥檚 forced to compete. 鈥淎mazon matches prices, using extensive monitoring systems that survey their own third-party sellers and other websites too,鈥� Pluimer explained. So if one mom-and-pop decides to mark down a few items on its own website, Amazon will adjust its pricing to theirs, which amplifies the discount to a massive scale. Thus, Amazon goes low when other retailers do. 鈥淏ut it doesn鈥檛 necessarily want to,鈥� said Peter Kearns. 鈥淎mazon is in it to make a profit.鈥�

Myth 2: Amazon Is Killing Brick-And-Mortar Retail

Actually, some retailers are thriving in today鈥檚 Amazon-dominated scene, said Mike Massey. 鈥淲hile I agree that some types of brick-and-mortar stores have struggled, they鈥檙e generally the mid-market guys that sell cheap, low-differentiation products,鈥� he explained.

However, specialty stores that offer consumers more than just cheap goods are doing extremely well, said Massey, who points to running shops as one example: By offering custom fitting and consultation, they deliver an experience that shoppers can鈥檛 get online. And 鈥淸Amazon] sucks at selling authentic gear, like snow skis, climbing gear, and ski jackets,鈥� said Massey. So to succeed as a brick-and-mortar, 鈥測ou really need to be able to differentiate both the shopping experience and what you鈥檙e selling.鈥�

When that happens, shops鈥攁nd entire shopping malls鈥攆lourish. 鈥淢alls that are anchored by something like a JCPenney have no foot traffic, but when they鈥檙e filled with interesting stores, they鈥檙e amazingly busy,鈥� said Massey.

Still, he said, brick-and-mortar retailers do need to figure out how to connect with consumers 24 hours a day, as Amazon does. People do their comparison shopping online, often during the evenings or other at-home hours. But they don鈥檛 necessarily need items to be shipped to them. 鈥淔ifty percent of Home Depot鈥檚 online purchases are for in-store pickup,鈥� said Massey. Plus, he added, citing a 2014 Google study, shoppers are 70 percent more likely to come to your store if they know you have what they鈥檙e looking for.

The takeaway? 鈥淢ake your inventory visible to consumers 24 hours a day,鈥� he suggested. And if you can figure out a way to out-Prime Amazon Prime by delivering your rain jacket to the customer who lives two miles from your shop? Even better.

Myth 3: Brands Can Control Their Pricing on Amazon

Fugeddaboudit. Amazon is an open marketplace that allows anyone to sell items, at any price. 鈥淭he only time I am aware that [Amazon] gets involved [in policing] is if there is a belief that counterfeit, illegal products are being sold,鈥� said Peter Sachs, general manager of Lowa Boots (which quit Amazon over pricing conflicts in 2017).

Some advisors maintain that strict relationships with third-party sellers can forestall price dives on Amazon. 鈥淵ou need to have a really good distribution strategy, with agreements that spell out your MAP policy,鈥� said Kearns. Still, unauthorized 鈥済ray market鈥� sellers have a way of popping up and undercutting that solidarity, said Massey, who suspects that Amazon itself creates fly-by-night resellers to unload stagnant inventory. 鈥淚 have no evidence to prove this,鈥� he admitted. 鈥淏ut every brand tracks who it sells to, and can verify that it didn鈥檛 sell product to a random pharmacy that opened a website seven days ago and is now unloading your goods at a deep听discount,鈥� he explained. 鈥淭he reality is, [policing] is a persistent game of whacka-mole.鈥� The only way to avoid that, Massey insisted, is to allow no third-party sellers鈥攏ot a single one. 鈥淏rands that allow nobody but themselves to sell on Amazon can feel confident that they鈥檙e always selling at full price.鈥�

Myth 4: Brands Can Safely Avoid Working with Amazon Because Their Specialty Retailers Will Sell Their Products Third-Party (3p)

That鈥檚 only true if the brand doesn鈥檛 care about creating a consistent image, said Pluimer. 鈥淚f you have 10 3P sellers, they often won鈥檛 show customers images and content that鈥檚 all aligned,鈥� he explained. In fact, it鈥檚 [the sellers鈥橾 job to differentiate themselves from competing retailers. Meanwhile, Amazon is offering brands more opportunities to use the Marketplace as a marketing vehicle, with increasing exposure for brand content and videos. 鈥淎mazon is an important consumer touchpoint that needs to be used deliberately,” said Pluimer.听“When brands and retailers assume that all of Amazon’s power comes solely from selling consumer goods, they’re seeing the tip rather than the whole iceberg.”

Myth 5: Amazon Plans to Cancel the Accounts of All Vendors Under $10 Million

Last year, after Bloomberg published an article speculating that Amazon would purge small suppliers, rumors spread. Amazon actually stepped in to say that the article was inaccurate. 鈥淚 happen to believe [the purge rumor] is false,鈥� said Pluimer. Still, he added, 鈥渆veryone at June鈥檚 Outdoor Retailer was asking me about it in panic.鈥� Moral of the story: beware of Amazon 鈥渘ews鈥� that doesn鈥檛 come directly from the company鈥檚 HQ.

Myth 6: Amazon鈥檚 Service Reps Go to Bat for Their Clients

Knowing that its brands appreciate some hand-holding as they negotiate the company鈥檚 regulations and tools, Amazon offers its own service representatives鈥攌nown as Strategic Vendor Services (SVS) and the Vendor Success Program (VSP)鈥攖o help companies jump through the hoops. But that system doesn鈥檛 let resellers or brands take their hands off the wheel, says Kearns. Amazon鈥檚 in-house reps prioritize that company鈥檚 goals and benchmarks鈥� which may or may not align with yours. They may push new shipping programs or international expansions, but brands must decide whether they truly benefit from Amazon鈥檚 initiatives.

And Amazon鈥檚 in-house reps won鈥檛 advocate for brands or negotiate better terms. 鈥淪VS will never go to Amazon and say, 鈥業 think these guys should be paying less,鈥欌€� said Pluimer. So as rising tariffs cut into brands鈥� profits, Amazon reps won鈥檛 campaign for cost adjustments.

Myth 7: Amazon鈥檚 E-Commerce Structure Is Environmentally Wasteful

Shipping stuff around the globe for home delivery seems like a ghastly waste of energy鈥攅specially when the packaging doesn鈥檛 always fit the item (most of us have, at some point, received a large Amazon box that鈥檚 empty except for one tiny item).

But Amazon is mending its sloppy shipping habits, said Pluimer. 鈥淚t uses the same amount of cardboard it did 10 years ago, despite having doubled its sales since then,鈥� he maintained. Amazon has also urged its brands to reduce their product packaging, since the e-commerce structure doesn鈥檛 rely on flashy shelf presentation to woo potential buyers.

Meanwhile, having scores of individual consumers hop into their cars and drive to stores isn鈥檛 so sustainable, either. Turns out, having one UPS truck drive around the neighborhood delivering packages is typically more efficient than having a legion of SUVs motoring to parking lots. 鈥淓-commerce is quite competitive, if not better than traditional retail distribution,鈥� Plumier said. That is, until the consumer requests one-day shipping, which spikes the fuel demands of moving product. Only then does e-commerce get a sustainability black eye.

Myth 8: Amazon Is Unstoppable

Everything is fallible鈥攅ven Amazon, which looks a lot like AOL to Massey. 鈥淩emember back in the 鈥�90s, when AOL seemed like it would displace all of everything?鈥� he asked. Yet AOL fell from relevancy, and poses a cautionary example for brands that assume Amazon is a rocket ship to triple-digit growth.

In fact, the complex web of businesses that Amazon owns makes it tricky to discern just how much of the behemoth鈥檚 profits derive from actual retail sales: Tech platforms, media production, web services, cloud storage, and a health care lab all make up slices of Amazon鈥檚 pie, so when brands and retailers assume that all of Amazon鈥檚 power comes solely from selling consumer goods, they鈥檙e seeing the tip rather than the whole iceberg. To Massey, betting everything on that tip seems like a poor gamble. Instead, he urges a balanced business model.

The post Amazon Myths: Busted appeared first on 国产吃瓜黑料 Online.

]]>

In 2019, Amazon became the largest retailer the world has ever seen. Here鈥檚 what that means for all of us

The post 25 Ways to Win on Amazon appeared first on 国产吃瓜黑料 Online.

]]>

When Jeff Bezos first launched Amazon way back in 1994, his original vision was to create an online store that offered a wide selection of books at affordable prices. What he actually created: a retail revolution that would fundamentally change the way consumers shop in the 21st century. This became increasingly evident as the company expanded its inventory to include just about anything that customers could possibly want, including outdoor gear.

鈥淭he outdoor category, like most Amazon product categories, was prioritized and developed as a function of consumer demand,鈥� said Larry Pluimer, CEO of Indigitous, a consulting firm that helps brands and retailers navigate the Amazon waters. 鈥淏ecause Amazon is a search engine, it can tell how many people are searching for 鈥榗amping tents鈥� versus 鈥榯oasters鈥�. As it turns out, a lot of people are searching for 鈥楾he North Face鈥�.鈥�

Before Indigitous, Pluimer spearheaded Amazon鈥檚 efforts to bring outdoor products to the Marketplace starting in 2009. Part of his job was developing Amazon categories that allowed sellers to merchandise gear like tents and crampons, but creating a proper online retail outlet for outdoor gear was only half the battle. Pluimer and his team also had to convince brands and retailers to join the Marketplace. That wasn鈥檛 very easy at first, but eventually it started to pay off. 鈥淎mazon was controversial and brands were reluctant to engage,鈥� Pluimer said, referencing a general distrust that many retailers and brands had for Amazon at the time. 鈥淏ut, in a couple of years, we had signed over 200 brands to sell to Amazon. Some of our early partners included Keen, Osprey, Eagle Creek, Sierra Designs, MSR, and Kelty.鈥�

Today, Amazon has grown into the largest retailer in the world, with annual revenues topping $200 billion. With more and more consumers turning to the website to find products, partnering with Amazon can be rewarding for both brands and retailers. But there鈥檚 more to succeeding in the ever-expanding Marketplace than simply slapping a few products on the site: Like any other part of a successful business, you need a strategy. Our list of 25 outdoor industry-tested tactics, tips, and best practices is here to help you develop the right one for you, scoring a win on the world鈥檚 biggest e-commerce website.

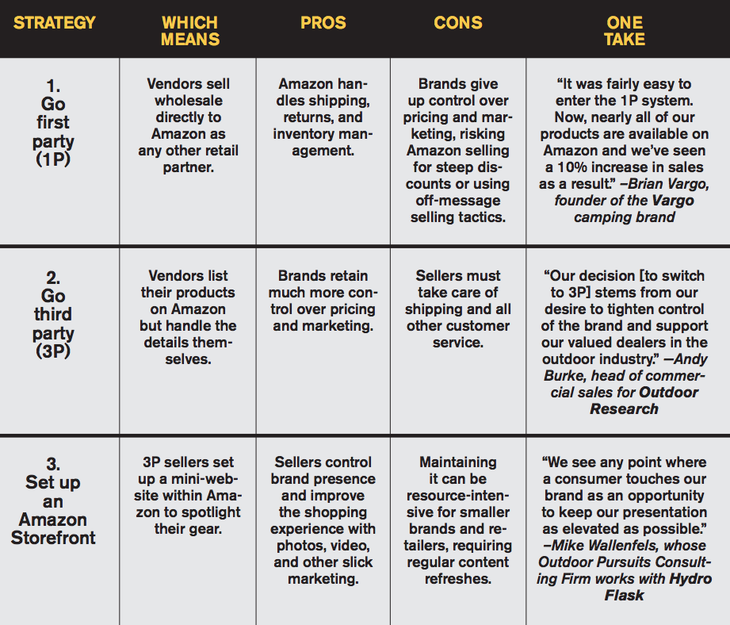

1-3. Choose Your Selling Approach

There are a few ways to join the Marketplace鈥攚hich is the one for you?

4. Nail SEO

Search engine optimization is just as vital on Amazon as it is on Google. Pay attention to proper keywords in titles, subtitles, bullet points, and product descriptions, but don鈥檛 get overly mechanical with your approach. 鈥淢ake sure your product listings read like they were written by a human and not a robot,鈥� said Yoon Kim, founder of Blogs For Brands, a company that assists outdoor brands with marketing and Amazon strategy. 鈥淎nd [remember that] Amazon does not account for misspellings. You鈥檒l need to include every possible misspelling of your product on the product description page in order to cover all your bases.鈥� As with Google, Amazon SEO can be confusing. Kim suggests bringing in some backup: 鈥淗iring an SEO expert can speed up projects and lead to better results, especially for tedious projects like Amazon copy.鈥�

5. Choose Your SKUs

Just because you鈥檝e made the decision to join the Marketplace doesn鈥檛 mean that you have to list every product your company has to offer. Many brands and retailers find value in only selling a portion of their catalog online. Outdoor Research鈥檚 Andy Burke said, 鈥淲e鈥檝e found that a segmented offering on Amazon provides both broad visibility for the brand and simultaneously provides a special experience for our brick-and-mortar retailers. Our specialty offerings are focused on key items and collections that are better served in the hands of educated sales staff and customer service people.鈥�

6. Mind Your MAP

Maintaining control of minimum advertised pricing (MAP) can be difficult in the free-for-all that is the Marketplace. Even authorized retail partners might drop prices too low in search of a quick sale, but 鈥淒on鈥檛 let rogue sellers define your price,鈥� Larry Pluimer said. 鈥淵our distribution policy needs to be deliberate and focused鈥濃€攚hether that means working with only a select group of trusted 3P partners, or even nixing 3P sellers altogether. Yoon Kim agreed: 鈥淲hen MAP gets out of control, Amazon is the first to know, and if Amazon stays under MAP, everyone eventually matches. Control your distribution so that if MAP issues arise, you can cut off a rogue seller.鈥�

7. Understand Amazon鈥檚 Reach

8. Create Opportunities for Impulse Buys

A recent survey of online shopping trends from CreditCards.com shows that 44 percent of Americans admit to making an impulse purchase in the last three months. Amazon sellers can take advantage of this trend by offering unique and useful products at very affordable price鈥攍ike the LifeStraw Personal Water Filter, which retails for just $17.47. 鈥淎mazon introduced our products to a massive audience who saw the value of being prepared for emergencies and having something lightweight and easy to add to their pack,鈥� said Tara Lundy, the company鈥檚 head of brand. 鈥淲e have a great business on Amazon. We utilize the platform to reach hundreds of thousands of customers who may not be able to access our products in-store.鈥�

9. Don鈥檛 Be Afraid to Break Up

Off-price Amazon competition eating into your brick-and-mortar business? You don鈥檛 have to take it anymore, says Wes Allen, owner of in Cody, Wyoming. 鈥淭he worst thing specialty retailers can do if they鈥檙e having this problem is to continue to write [orders with] the brand,鈥� Allen said, noting that his store has stopped carrying gear from brands that couldn鈥檛 or wouldn鈥檛 rein in below-MAP sales on Amazon. 鈥淭here are very few brands out there making things that somebody else doesn鈥檛 make. Look around at who has the best brand hygiene and figure out who you want to work with.鈥�

The key, said Allen, is tracking prices and opening up conversations with vendors based on data. Sunlight Sports will match a lower Amazon price in the store, and Allen receives a daily sales report noting how often that happens. He then takes those numbers to brand partners: 鈥淵ou have to show them what the impact is. Tell them what you鈥檙e seeing so they can take action.鈥� And if they don鈥檛? Find someone who will. Allen says he鈥檚 increased orders with The North Face, K脺HL, and Nordica in recent years in part because they do a great job controlling MAP across the board.

Champaign Outdoors in Illinois automatically price matches products over $30. “”The reality is, customers will pull out their phone and look to see if they can get a better deal on something. And who can blame them?” Owner Dan Epstein said. “But we are pretty confident that we curate brands with strong protection online.”

10. Spend Money to Make Money

Don鈥檛 overlook the benefits of buying ad space from Amazon. You鈥檒l catch the attention of more shoppers and potentially even push items onto the first page of search results. Want to see this in action? Do a search for Patagonia鈥攁 brand that isn鈥檛 even officially part of the Marketplace鈥攁nd see what comes up. Besides Patagonia gear from unauthorized sellers, you鈥檙e also likely to find advertisements for The North Face or Columbia displayed along the top of the page, giving the competition the chance to lure away potential customers.

11 & 12. Tap into Prime Customers

Amazon鈥檚 100 million-plus Prime members spend $1,400 per year on the website鈥攎ore than double that of regular shoppers鈥攎aking them a good group to get to know. But you鈥檒l have to pick one of these two sides to reach them.

| 11. Go with FBA | 12. Go with SFP | |

| AKA | Fulfilled by Amazon | Seller Fulfilled Prime |

| Which means | When sellers join the FBA service, they send products to Amazon to handle shipping and customer service. | Sellers still gain access to Prime members, but must handle one-day shipping and other customer service matters themselves. |

| Pros | Easy | More affordable |

| Cons | It’ll cost you in fees. | It鈥檒l cost you in time and manpower. |

13. Fight Back Against Counterfeits

Copycat merchandise and outright counterfeits can make operating on the Marketplace a challenge at times, eating into legitimate sales for authorized retailers and gear manufacturers alike. But by taking an active part in the Amazon ecosystem, brands gain access to Project Zero, a program designed to hunt down and remove counterfeits. The system uses machine learning, product serialization, and old-fashioned human diligence to protect a brand鈥檚 intellectual property on the Marketplace.

Sellers can also join the Amazon Brand Registry (ABR), which provides enhanced search options that let companies locate and stamp out trademark infringement on the Marketplace. How effective is it? According to Amazon, more than 130,000 brands have joined the program, and members report 99 percent fewer suspected trademark infringements since before the tool was launched in 2017.

Nite Ize and OtterBox have both had issues with counterfeits on Amazon; both sued companies for violating their trademarks, with Amazon joining in on the lawsuit (OtterBox won; Nite Ize is awaiting its day in court).

14. Capitalize on the Prime Day

Beyond Black Friday and the holiday shopping season, Amazon鈥檚 own Prime Day, an exclusive sale that takes place in mid-July, has grown into a significant sales opportunity. A well-timed sale, advertising campaign, or product launch during these events can result in massive success for a seller.

Just how much of an impact can Prime Day have? LifeStraw, which allocated some of its budget to Amazon鈥檚 paid search platform and ran a timely sale, sold more than 200,000 units of its Personal Water Filter on Prime Day 2019 alone, making it one of the top-selling products in the U.S. and Canada and increasing its visibility dramatically. That helped the company achieve another one of its goals: providing safe drinking water to students around the globe. 鈥淲ith the sales from Prime Day 2019 alone, we were able to reach over 200,000 more school children,鈥� said Head of Brand Tara Lundy.

15. Embrace a Product鈥檚 Amazon History

Introducing a new version of a legacy product? Don鈥檛 reinvent the wheel. Rich Hill, president of Grassroots Outdoor Alliance, has consulted with dozens of brands and retailers on how to best work with Amazon. He鈥檚 learned the value of consistency on the Marketplace, telling clients, 鈥淣ever change the name of a product. When you do, you lose all of that product鈥檚 history on Amazon, including reviews and customer feedback. Those items play a role in page rankings and are difficult to replace or rebuild.鈥� Case in point: the Nalgene wide-mouth water bottle, with nearly 6,500 ratings and a 4.7/5 average. 鈥淚t doesn鈥檛 change, it鈥檚 iconic, and it just keeps building its ratings,鈥� Hill noted.

16. Turn Alexa into Your Pitch Person

Amazon鈥檚 popular voice assistant, Alexa, can be used for more than just answering trivia questions. In fact, just about anyone can create an Alexa Skill, which is essentially a voice-activated app that delivers custom functionality. Clever brands have already found creative ways to engage with their customers, like REI鈥檚 Skill, which touts the brand鈥檚 Deal of the Day and provides store locations and events. Other brands outside the outdoor industry deliver recipes (Campbell鈥檚) or daily allergy forecasts (Zyrtec). Right now, the market is wide open for a branded Skill that delivers hiking trail suggestions, ski area snowfall reports, or packing lists for camp outings. You鈥檙e welcome.

17. Win the Buy Box

As a retailer, how do you stand out from the hordes of other sellers hawking the same gear? Data show that 82 percent of all sales on Amazon come from the Buy Box鈥攖he section on the product details page where customers can add an item to their cart or purchase it instantly. The Buy Box is an important piece of real estate on the Marketplace because it often lists multiple retailers that are offering the same product. In short: You want to be in there.

Sellers who earn that coveted space must satisfy Amazon鈥檚 algorithm by offering that product at a highly competitive price with the cost of shipping factored in. They must also have inventory on hand to fulfill the order, and a good seller rating based on customer feedback over the past 30, 90, and 365 days. Any retailer who meets those criteria greatly increases its chances of being listed in the Buy Box, even on a competitor鈥檚 page selling the exact same product.

18. Don鈥檛 Go It Alone

19. Fill Up Your Photo Album

Data show that good photos help keep customers on a product page longer and result in higher conversion rates. In fact, consultants advise that Amazon shoppers value high-quality images more than the descriptive text that appears on a product page. Amazon lets sellers include up to six images on any product page, but often brands and retailers don鈥檛 use all of the available space. As Fred Dimyan of consulting firm Potoo pointed out, 鈥淭hat鈥檚 equivalent to Target giving you seven feet of retail space, but you only use two of those feet.鈥�

20. Learn to Master Your Channel

If you鈥檙e looking for insightful and creative tips for how you can succeed on the Amazon Marketplace (and on an array of other e-commerce platforms), then the Channel Mastery podcast (channelmastery.com) is a must-listen. Each week, host Kristin Carpenter welcomes smart, plugged-in guests from a wide range of industries to discuss strategies and techniques designed to meet the unique needs of outdoor brands and retail outlets. 鈥淭he podcast came about because there were no other resources available for specialty retailers,鈥� Carpenter said. Tune in to a special Channel Mastery series produced in partnership with OBJ.

21. Sell the Right Stuff

The Marketplace may be huge, but it鈥檚 not the best outlet for everything, says Rich Hill. Accessories, commodity items, and replenishment products (think: another pair of your favorite socks) kill it on Amazon, while high-touch, fit-dependent gear is a tougher sell.

22. Go on the Hunt for Unauthorized Sellers

There are outright counterfeiters, and then there are unauthorized resellers. The latter cuts into sales and margins by dumping product at steeply discounted prices. These sellers don鈥檛 have permission to sell a brand鈥檚 merchandise on the Marketplace, but do so anyway. They often obtain a brand鈥檚 merchandise through backchannel means, finding a wholesaler who鈥檚 willing to sell product with no questions asked or sometimes even going directly to the factory. The end result: Sales get siphoned away from legit sellers.

Amazon can help brands stomp out these unauthorized sellers, but sometimes it pays to get a little outside help. Potoo Solutions uses proprietary data analytics to rein in resellers for many of its more than 500 clients.

鈥淲e can reduce unauthorized sales by as much as 83 percent,鈥� said Potoo CEO Fred Dimyan. 鈥淚n doing so, the average selling price of a product goes up, both on Amazon and in brick-and-mortar retail outlets, which often end up seeing better sales in the long run.鈥�

Or go it alone: In 2017, Osprey launched a systematic campaign to shut down anyone who didn鈥檛 have permission to sell its products on Amazon. That process began by surveying the activities of all of its retail partners, including ones that had been working with the company for years. The result was new contracts that restricted Amazon sales to a few trusted partners, bringing the number of authorized sellers down from nearly 200 to just eight in about a year.

23-24. Don鈥檛 Put All Your Eggs in One Basket

Amazon may be a sales juggernaut, but don’t focus all your e-commerce energy there. Here are three smart ways to diversity your strategy.

Turn Online Browsers into Local Customers

“We set out to build bridges between online and offline shopping,” said Mike Massey, co-founder of Locally.com. How, exactly? The website helps online shoppers find the products they’re looking for at a nearby brick-and-mortar outlet.

Customers can go directly to the Locally website to search for an item: The site then scans its database to find that specific product and examines the inventory of stores located close to the customer to find where it is available. Or browsers on brand’s own website will see a “buy it locally” option when perusing specific products. Both options drive shoppers to local retailers, where they can usually pick up their purchases the very same day.

Win the Delivery Game

One of Amazon鈥檚 biggest appeals is a vast distribution network that allows it to conveniently ship products to a customer鈥檚 door, fast. But Amazon doesn鈥檛 own speedy delivery. Last August, Brooks and Locally launched Locally On-Demand, a program that allows shoppers to see merchandise that鈥檚 available in local retailers, buy it, and have it delivered the same day for a small fee. This usually matches or even beats Amazon鈥檚 ability to ship quickly and cheaply.

The program is now available in 2,200 U.S. cities and is growing at a rate of 365 percent per month.

25. Make an Escape Plan

And finally, a counterpoint: For some brands, divorcing Amazon actually is the best move. When Lowa Boots saw margins on its products shrinking due to unauthorized Amazon resellers automatically matching steeply discounted prices, the company made the tough decision to exit the Marketplace altogether. Cutthroat competition was impacting nearly all of Lowa鈥檚 retail partners, and leaving Amazon helped to reverse that trend, although the transition wasn鈥檛 easy.

鈥淲e knew the day we stopped our business would go down, and it did,鈥� Lowa General Manager in the U.S. Peter Sachs said. 鈥淲e predicted a two-year claw-back, and that鈥檚 what it took for topline sales to get us back to where we had been.鈥� Eventually, both online and traditional retail sales adjusted to the shift away from Amazon and things began to turn around. 鈥淎mazon has some heavy expenses attached to it, and without them our expenses did go down and our margins increased,鈥� Sachs added. 鈥淭he end result is that we have a heathy, diversified, and profitable business鈥濃€攑roof that there can be life after Amazon.

The post 25 Ways to Win on Amazon appeared first on 国产吃瓜黑料 Online.

]]>

The company's Gearheads talk to millions of customers every year, so they decided to do something with their feedback鈥攎ake their own gear

The post An Exclusive Interview with Backcountry CEO Jonathan Nielsen appeared first on 国产吃瓜黑料 Online.

]]>

In front of a room of journalists in March, Jonathan Nielsen described himself as really good snowboarder, a frequent mountain biker, and an adequate climber. The audience chuckled and the听Backcountry听CEO took a pause before spilling his excitement over the company’s biggest namesake product expansion to date. The collections鈥攃limb, apparel, and travel launched for spring/summer that week, mountain bike launched a few weeks ago, and ski and snowboard launch later this year鈥攏ot only build on the company’s first foray into gear making in 2018, but mark a new era for the brand that was founded in 1996 by two ski bums.

After his presentation at the headquarters in Park City, Utah, 国产吃瓜黑料 Business Journal sat down with Nielsen for a one-on-one interview to discuss the company’s growth, first as a service and now as a brand. He told us that Backcountry’s customers have evolved to identify themselves by more than one outdoor activity鈥攖hey’re climbers, cyclists, runners, yogis, snowboarders, skiers, mountain bikers, and more. And it’s part of Backcountry’s strategy to develop the best gear possible, based on feedback from millions of customers over 20 years.

On pushback from other brands when Backcountry decided to make its own gear:

“There鈥檚 been less pushback than I expected. It鈥檚 2019. Everyone gets where we鈥檙e going from an industry perspective. Not everyone loves it, but they understand it and it鈥檚 a sound decision and the right thing to do for all of our businesses. The best retailers and brands are trying to get closer to having a deep relationship with customers.听We鈥檝e got to do what鈥檚 right for our customer and what鈥檚 healthy for our business. Our customer wants Backcountry product. They鈥檝e said it over and over again. When I get questions about pushback, I flip it on its head and say, for us in an Amazon-driven world, we need to have unique product that enriches our brand and will make our business healthy. The healthier we are as a business, the better we鈥檙e going to partner for you. Similar to how brands go direct to consumer and that makes you healthy, building our own product ultimately makes us a healthier business.”

On bringing brands together for the collection:

“Because we鈥檙e this hybrid retailer becoming a brand, we can bring people together. If you look at our touring collection last year, it was Flylow, DPS, Black Diamond. This year, it’s听Black Diamond and DPS again, Edelweiss, Metolius, So iLL, Gore-Tex, and Burton. There鈥檚 not really another paradigm where those all come together鈥攐utside of just a traditional retail setting鈥攖o create a full kit together. I think we have a unique ability to do that. We have a consumer they all want to reach.”

On giving the ever-evolving customer what they want:

“We鈥檝e really embraced this notion of lifestyle. Twenty years ago, people were like, I鈥檓 a skier. We find that our customers do multiple sports and they actually want to wear apparel that represents who they are. We have a lot of great brands that hit that hit that nexus of outdoor. There鈥檚 a trend with athleisure. You go to a climbing gym, everyone is climbing in leggings. It鈥檚 comfortable and it works and it looks great. We have brands like Alo and Beyond Yoga. They hit that combination, especially for our female customer, of functional, looks great, performs. It鈥檚 everyday wear, plus you can climb in it. Everyone鈥檚 doing it. One of our bestselling products in 2018 was our female fleece-lined tight. We sold out of it.”

On selling on Amazon:

“One of the levers that Amazon uses to get brands to join is if you鈥檙e not on, they don鈥檛 police gray market and they let it be the wild west. They say, hey if you come on, we鈥檒l get rid of all this gray market stuff for you. We do participate in the marketplace as a third-party seller, but that鈥檚 a direct function of whether our brand partners are on Amazon or not. In a perfect world, we would love specialty to be specialty. But I understand. Roughly 50 percent of all e-commerce growth comes from Amazon, so I get it. Brands need to tap into that channel and if they鈥檙e going to do that, what we like to do is help them think through it because we鈥檙e actually quite good at e-commerce and quite good at the Amazon ecosystem.”

On the health of brick-and-mortar retail:

鈥淚 don鈥檛 think retail is going away, it鈥檚 just different. Retail used to be just a function of location, right? When there鈥檚 no internet, it鈥檚 like, I own this location and therefore that is convenience. The internet blew that up. Now, you have to tell a story, you have to offer the customer something different than just a spot down the street. I think for a lot of retailers, it鈥檚 hard.”

On the inspiration for the Gearhead program:

“I think everyone thinks technology is here to destroy everything. I don鈥檛 have that view. And Gearheads are a great example. We actually think that personalization for us is less algorithmic and more people鈥攊t鈥檚 the people that enrich the website experience.听You used to just walk down the street and say, yeah you鈥檙e my person.听We take that local shop experience and give you access to it in a 2019 kind of way.”

On what鈥檚 next for Backcountry:

鈥淭he backcountry brand is here to stay. We had a small launch in 2018 and we鈥檙e taking a giant step forward in 2019. I think you鈥檒l see continual large steps forward. Our goal is to become a major outdoor brand on the product side and continue to do what we鈥檝e always done on the retail side and lean in to our Gearhead program.鈥�

The post An Exclusive Interview with Backcountry CEO Jonathan Nielsen appeared first on 国产吃瓜黑料 Online.

]]>

Outdoor industry leaders shine a light on the crux of the issue鈥攖hat selling on the "cheapest retailer's" website changes consumer鈥檚 perception of brands, putting specialty retailers at risk

The post Why Brands Quickly Changed Their Minds About Selling on Walmart.com appeared first on 国产吃瓜黑料 Online.

]]>

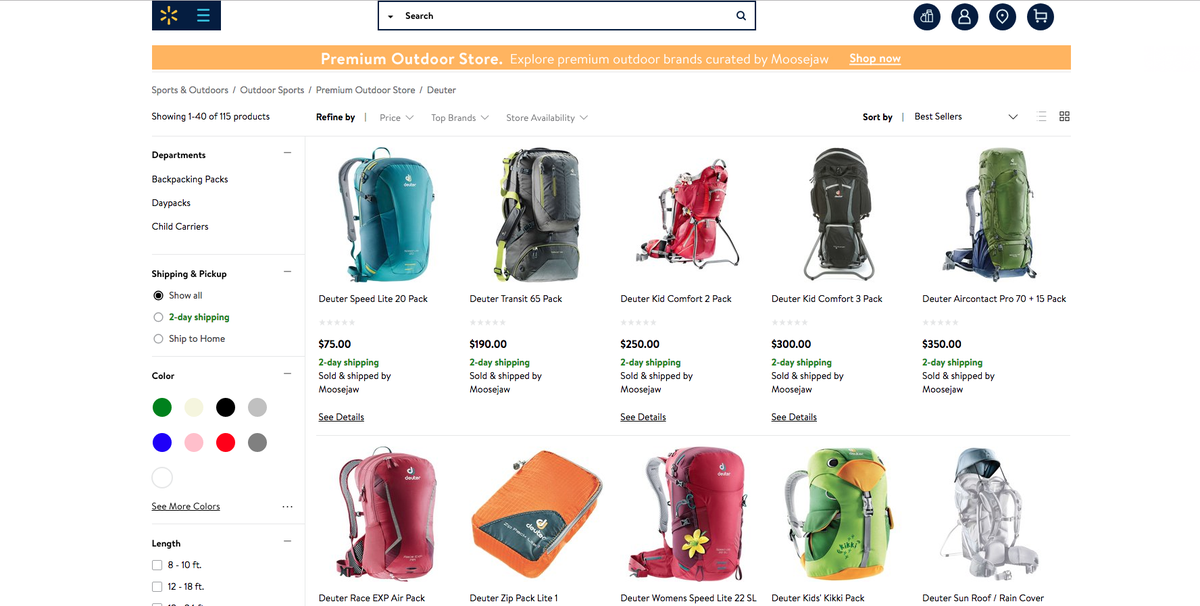

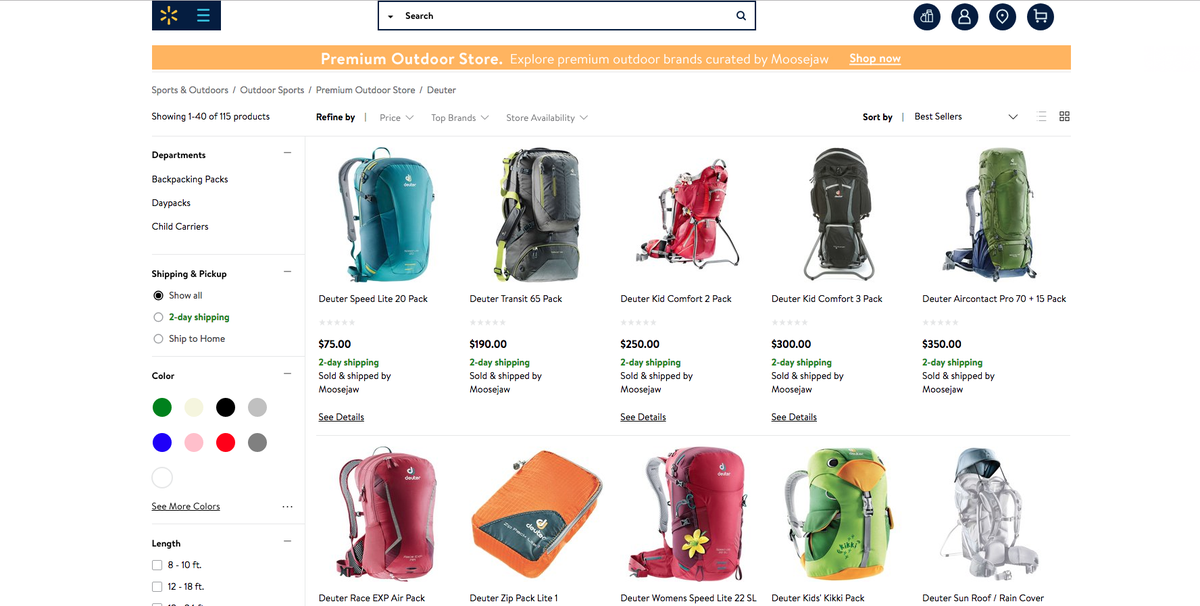

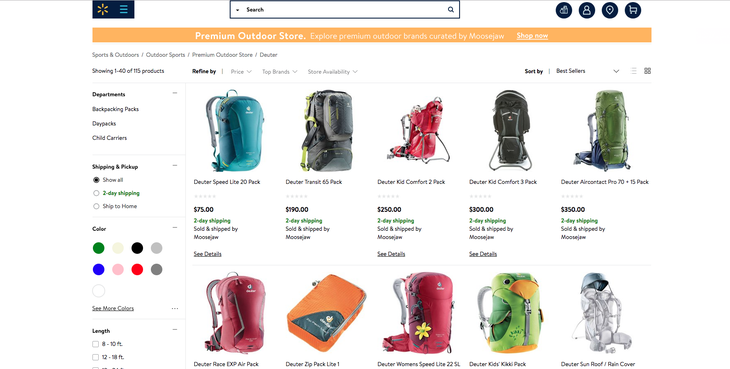

It鈥檚 safe to say American shoppers don鈥檛 go to Walmart looking for top-of-the line backpacks, winter expedition apparel, and mountaineering gear. But the big box discounter challenged that assumption with the launch of a premium outdoor store last week.

鈥淲hen鈥檚 the last time you bought something nice from Walmart?鈥� said Wes Allen, owner of Sunlight Sports in Cody, Wyoming.

As Walmart continues to build its online marketplace in an attempt to keep up with Amazon as the sell-everything search engine, outdoor industry leaders say that brands can no longer ignore Walmart as part of their omni-channel strategy. They now need to decide if they want to be a pawn in the game.

Sure, individuals at the company might have a genuine interest in the mountains鈥擥reg Penner, chairman of the Walmart board of directors, reached the summit of Mt. Everest this summer. But since 2016, Walmart in its race with Amazon has been adding听 inventory and brands by the thousands through third-party sellers. You can browse $200 handbags and upscale beauty products on the site鈥攕omething you can’t do in stores. In 2017, Walmart acquired a number of brands: the men鈥檚 line Bonobos, hipster women鈥檚 clothing site Modcloth, and Moosejaw, a reseller of some of the best brands in the outdoor industry. As expected, Walmart gained access to those and stocked its 鈥渃urated by Moosejaw鈥� store with nearly 50 different brands, from Black Diamond Equipment to Deuter.

For a store built on a foundation of bottom-of-the-barrel prices and quality, many people commented that it makes no sense for Walmart to sell the best of the best. Amazon has prioritized pricing and selection, but others made the argument that if brands sell on Amazon, why wouldn鈥檛 they sell on Walmart.com?

Who Withdrew?

What was appealing about the deal, according to insiders, was the chance to control third-party sellers and distribution, and list products online at full MSRP. No discounts. It鈥檚 important to note that Moosejaw is still a well-respected retailer in the industry, despite its new parent, and brands were willing to support them. But some brands quickly realized that selling on the Walmart-branded platform immediately shattered trust with specialty retailers, some of whom halted orders, and with consumers who define their image by where they shop.

鈥淢any brands are not playing a particularly long game here,鈥� said Mike Massey, founder of Locally and owner of Massey鈥檚 Outfitters. 鈥淚t took them 30 years to build their goodwill and reputation with consumers and making the wrong decision here with their intellectual property is like flipping a coin with the future. There鈥檚 a lot of large companies who would be happy to cash that goodwill in for one great quarter.鈥�

While $200 Deuter backpacks and $100 Black Diamond harnesses were on the microsite, some feared that, based on Walmart鈥檚 decades-old status, prices would eventually drop or products would be thrown into the mix on shelves in stores.

鈥淔or retailers, we鈥檙e ordering product a year ahead, based on product selection and brand positioning. We鈥檙e taking delivery of it now for fall and betting our livelihoods that we鈥檙e going to be able to sell it for enough money to pay rent, pay employees, maybe put our kids through college,鈥� Allen said. 鈥淵ou build relationships with people you trust that sell you things. Then somebody opens in Walmart, with no explanation. Your order ships next week. Would you still take that order? A brand鈥檚 worth has to do with how people feel about it.鈥�

In the video below, Allen talks to Verde Brand Communications founder Kristin Carpenter-Ogden about a number of aspects of the Walmart debate.

A little more than 24 hours after the launch, the fallout began. Black Diamond was the first to respond. The company sent a cease and desist notice demanding Walmart stop using logos and product images on the website. In the days following, Deuter, Katadyn, Leki, Yakima, Native Eyewear, and Therm-a-rest changed their minds about being sold through Walmart.com.

Shawn Hostetter, president of Katadyn North America, said, 鈥淲e made this decision after listening to the retailers we partner with鈥攊n doing so it became clear we needed to remove our brand and products from Walmart.com to best support their needs and to best caretake our premium brand position.鈥�

At the time of publication, Craghoppers, Klymit, Grand Trunk, Orca Coolers, PacSafe, Tentsile, Teton Sports, ExOfficio, and 18 others were still listed on the site.

Moosejaw’s Response

Eoin Comerford, CEO of Moosejaw and general manager of outdoor at Walmart e-commerce, in a LinkedIn post on Friday addressed concerns. He said that if the outdoor industry wants to advance beyond being exclusionary and dominated by a few large retailers, then they have to adapt to new ways and keep an open-mind. The retailer is known for not taking itself too seriously and because of that, according to Comerford, it has attracted beginner outdoor enthusiasts intimidated by the industry鈥檚 elitism.

鈥淚 wasn鈥檛 na茂ve enough to think that all outdoor retailers would welcome the Premium Outdoor Store with open arms, but I am surprised by the vehemence of attacks by some of our industry鈥檚 leading retailers and the threats to drop brands that participated,鈥� Comerford wrote.

Diversity, equity, and inclusivity have been leading topics in the outdoor industry. As a whole, the predominantly white and predominantly male industry is trying to figure out how to welcome and include more diverse populations.

Comerford said that in launching the store, he kept in mind how it would expose outdoor brands and activities to a massive audience, including underrepresented groups. In its response to Black Diamond, Walmart鈥檚 statement said: 鈥淎t a time when the outdoor industry is working hard to expose more people to the amazing experiences they can have outside, we feel like [having a premium outdoor store is] a really positive development.鈥�

However, others in the outdoor industry see it as a tactic. Rich Hill, president of Grassroots Outdoor Alliance, a consortium of more than 60 independent outdoor specialty retailers and more than 60 vendor partners, believes that the new site will not reach any new customers.

鈥淣ot a single new climber will discover their love of the sport through Walmart.com,鈥� Hill wrote in an email. 鈥淚t鈥檚 just expanding the number of locations customers can search for a lower price.鈥�

Walmart’s Specialty Veneer

In a continued effort to give consumers a special experience鈥攚alking through the front doors and feeling at home or stoked on adventure鈥攔etailers strive for quality customer service. Some, like Summit Hut in Tucson, Arizona, even rearrange their shops to guide shoppers through each brand鈥檚 stories. And with the rise of social media, brands are using storytelling to connect with fans. Think Patagonia鈥檚 Worn Wear and Merrell Magic.

Large corporate structures are trying to harness that magic and contribute by providing supplies needed for those premium experiences. Allen says that big box conglomerates鈥攕uch as Camping World Holdings buying beloved retailers Erehwon and Rock/Creek Outfitters鈥攁re attempting to engage shoppers in their hearts and emotions like specialty does.

鈥淚 totally get it鈥攊t鈥檚 flattering,鈥� Allen said. 鈥淭he environment that created that desirability needs to be protected if it鈥檚 going to survive. You can鈥檛 just rip it up by the roots and throw it out on a Walmart shelf and hope it survives. We need to safeguard this thing and water it.鈥�

Hill said that any brand that chooses to do business with Walmart has become irrelevant with specialty retail, REI, Backcountry.com, or even their own DTC strategies.

鈥淚 see it mainly as a desperate move by brands that cannot see a path forward other than to get in bed with the most dangerous retailer on the planet,鈥� Hill said.

And Massey said the most important thing brands can do is apply some of the same lessons they鈥檝e learned in brick and mortar to online, and make sophisticated decisions about how they want their products merchandized online.

鈥淢ost would never tolerate their merchandise shipping into Costco simply because lots of customers go there, but some might,鈥� Massey said. 鈥淎nd, on the other hand, just because someone is a dealer for your products in Waco or Bend doesn鈥檛 mean they should automatically be allowed to sell them online. Having no channel strategy is the worst-case scenario. It鈥檚 like trying to open 15 dealers in the same mall and hoping for the best.鈥�

If retailers and brands have learned anything about selling through Amazon and developing an omni-channel strategy, it鈥檚 that they have to consider it from all angles. And now Walmart is part of that sphere.

The post Why Brands Quickly Changed Their Minds About Selling on Walmart.com appeared first on 国产吃瓜黑料 Online.

]]>

Ignoring the ecommerce behemoth isn鈥檛 an option anymore鈥攂ut that doesn鈥檛 mean navigating this channel is easy

The post The Outdoor Brand Playbook, Part 5: Developing an Amazon Strategy appeared first on 国产吃瓜黑料 Online.

]]>

The Challenge: Taming the Amazon Beast

For many in the outdoor industry, Amazon has become something of a dirty word. Yes, distributing through the ecommerce giant can grant access to a huge global customer base (plus help with fulfillments, customer service, and marketing). But it also opens vendors up to a host of issues, from loss of control over pricing to discounting wars among unauthorized resellers to the risk that Amazon itself will study sales data and build its own (cheaper) version of the gear.

The minefield begins in vendor central, the option in which brands distribute product directly through Amazon. Because Amazon makes no bones about its goal of providing the lowest possible price鈥斺€淎mazon sets its retail prices independently and believes in delivering the best possible value to our customers,鈥� a spokesperson said via email鈥攖he company sometimes ignores MAP policy. 鈥淢AP policies are only enforceable by their manufacturers,鈥� said Christian Gennerman, VP of marketing and strategy at 180 Commerce, a consulting firm that specializes in Amazon strategy. 鈥淲hat happens is a lot of these manufacturers sell to Amazon and it becomes their number-one account. How do they say, 鈥業f you don鈥檛 follow MAP, we鈥檙e shutting you down鈥�? It鈥檚 difficult to walk away from purchase orders.鈥�

There鈥檚 always the option of going with third-party resellers on the Amazon Marketplace instead鈥攂ut vendors that aren鈥檛 careful about policing them risk more pricing problems because Amazon incentivizes resellers to compete ruthlessly for the lowest price. 鈥淭here鈥檚 constant pressure to undercut all the other people on the platform,鈥� said Rich Hill, president of Grassroots Outdoor Alliance. 鈥淏y nature, it tends to get into the death spiral of discounting. When you ignore it, it becomes the Thunderdome of retail鈥攅verybody in there with hatchets and spiked maces, nobody makes money.鈥�

The Newest Threat: AmazonBasics

In recent years, a new threat has emerged: the AmazonBasics house brand coming out with comparable outdoor products, at much lower prices. The company has access to detailed sales data for everything listed on Amazon, which it can mine for hot sellers and use to create its own knockoffs鈥攍ike a $55 internal-frame backpack or a $42, four-person tent. 鈥淭hey鈥檙e picking the products that are selling,鈥� said Gennerman. 鈥淭hey can outbid you, and they can out price you. The reality is, they can sell this product at a loss in order to get the customer on board. They鈥檙e in it for the long haul.鈥�

That kind of copycatting can affect a brand鈥檚 other, offline distribution channels, too, noted Kristin Carpenter-Ogden, founder of Verde Brand Communications and host of its Channel Mastery podcast: 鈥淲hat will make a retailer successful carrying your brand if Amazon comes out with a trekking pole that costs 50 bucks, but has the same features and benefits?鈥�

Amazon, for its part, argues that the market is big enough to support a variety of options. 鈥淐ustomers come to Amazon for the wide selection of products we offer, and that includes a variety of different brands they know and love,鈥� said a spokesperson via email. 鈥淭here is room for many players in the categories where Amazon offers private label products, and products from vendors and third-party sellers continue to be bestsellers across various categories.鈥�

And yet鈥斺€淚t鈥檚 not feasible for most brands to say no to Amazon,鈥� Gennerman said. 鈥淪ixty-six percent of all searches for product originate on Amazon. If you鈥檙e not selling your product there, someone else is selling a product very similar to yours, or selling your product.鈥�

The Fix

Deal with Amazon, but do it carefully by offering only a selection of your brand鈥檚 total line, and/or work only with a small number of trusted resellers in the Marketplace. Pay close attention to overall distribution to prevent unauthorized dealers from steeply discounting gear.

The Strategy

Make Amazon work for you instead of the other way around through careful distribution decisions and professional help.

>> Consider line segmentation One way to keep specialty retailers happy: Sell only some gear on Amazon. 鈥淭he products that make sense for a budget-hunting consumer鈥� might be the best fit, suggested Carpenter-Ogden. 鈥淭hat won鈥檛 cannibalize the high-end retailers.鈥� But avoid trying to trick customers with a slightly tweaked, discounted version of an existing product, warned Hill. 鈥淭he end consumer knows they鈥檙e being gamed,鈥� and retailers could drop the brand as a result.

>> Be selective about partners The more third-party resellers you work with, the greater the chance for discounting to spin out of control or for unauthorized dealers to start selling gear, said Gennerman. He advises working with just one trusted reseller if possible. Side benefit: having fewer resellers makes it much easier to keep marketing messages and price consistent across all channels.

>> Get help Some consulting firms specialize in helping vendors come up with solid Amazon strategies, tell a consistent brand story, and track down unauthorized resellers and counterfeit gear.

>> Make MAP enforcement a job It鈥檚 easy for Amazon dealers to slash prices with abandon if nobody鈥檚 watching. Osprey Packs has one employee who spends two-thirds of her time policing MAP compliance, plus other watchdogs across different programs.

Case Study: Osprey Packs

One year ago this month, a shopper could find almost 200 sellers hawking Osprey gear on the Amazon Marketplace: 38 authorized dealers and up to 150 unauthorized ones, 鈥渟elling our product at either full or discounted retail,鈥� noted Bill Chandler, director of domestic sales at Osprey Packs. 鈥淚t turned into a wild, wild West scenario,鈥� with some of these shadowy resellers slashing prices up to 20 percent.

The company was well aware of the problem, but actually tamping it down remained a major challenge. Someone at Osprey would call some dealers whenever an off-price product popped up, 鈥渂ut it became a Whac-a-Mole game,鈥� Chandler said. 鈥淲hen you have that many people playing in the arena, there鈥檚 only so many hours in the day you can devote to it.鈥�

So Osprey decided to crack down. Some of the offenders were authorized brick-and-mortar partners who just weren鈥檛 cleared to sell on Amazon; in those cases, a direct phone call often fixed the problem. In other cases, it wasn鈥檛 clear who the resellers were or how they got the product, so employees did detective work to track them down and sent cease-and-desist letters. Osprey occasionally bought product online in order to track the sellers through their shipping addresses, and Chandler even personally knocked on a few doors after tracing unauthorized addresses to private homes (nobody ever answered).

But the real breakthrough came when Osprey started to reauthorize 100 percent of its U.S. dealer network. 鈥淓very dealer, no matter if they鈥檝e been with the brand for 40 years or two years, had to reapply,鈥� Chandler said. 鈥淪o now I have a way to legally enforce our pricing policy.鈥� Some longtime partners were irked, he noted: 鈥淣ow that we鈥檙e trying to put on our big boy pants and be conscientious of the value of our brand at retail, [we鈥檝e been] met with some challenges.鈥� But explaining that the move was meant to protect the dealers鈥� full-price business usually smoothed things over.

Now, Osprey is down to just eight authorized third-party resellers on Amazon, all trusted, existing dealers with storefronts and a commitment to the brand鈥檚 unilateral pricing policy. Osprey鈥檚 leaders plan to see how this strategy plays out for at least six more months before deciding if they want to expand that number. For now, though, the brand feels a bit more in control of the former Amazon free-for-all, but knows there鈥檚 still work to do. 鈥淚 don鈥檛 think our hands will ever touch,鈥� Chandler said, 鈥渂ut we鈥檇 like to get our hands further around the ball than we currently have it.鈥�

The post The Outdoor Brand Playbook, Part 5: Developing an Amazon Strategy appeared first on 国产吃瓜黑料 Online.

]]>

What was it Abraham Lincoln said about a house divided? When a vendor鈥檚 internal channels compete, everybody loses鈥攂ut when they work as a team, businesses thrive

The post The Outdoor Brand Playbook, Part 2: Managing Channel Conflict appeared first on 国产吃瓜黑料 Online.

]]>

Successfully producing outdoor gear used to be such a simple endeavor: make great product, then sell it through retail partners, or directly through a catalog or your own store. These days, the formula has become a lot more complicated. With the option to distribute through a suite of channels鈥攕pecialty retailers, big-box retailers, directly to consumers via ecommerce and/or your own storefronts, through Amazon鈥檚 vendor central or Amazon resellers鈥攂rands must pull off a delicate balancing act and juggle a network of relationships to get their gear into customers鈥� hands. The good news? This swirl of channels also presents an opportunity to reach consumers wherever they are, telling a vibrant brand story while enhancing the shopping experience like never before. Over the next few weeks, OBJ will take a closer look at best practices for vendors in an increasingly omnichannel world.

The Challenge: Preventing Channel Conflict

Maintaining multiple distribution branches of a business comes with at least one significant pitfall: the tendency for the direct-to-consumer side to view the wholesale side as a competitor, setting up a classic channel conflict trap that too many vendors fall for, said Locally founder and Massey鈥檚 Outfitters owner Mike Massey. He鈥檚 seen instances of DTC or web teams actively trying to steal sales from the wholesale side of the business. Sometimes it鈥檚 subtle, such as designers burying a website鈥檚 dealer locator tool; other times, it鈥檚 as aggressive as pushing a DTC-only discount, surprising the retail side of the business and violating the brand鈥檚 own MAP policy in the process. But when a brand views sales across channels as a zero-sum game, everybody loses.

For one, trying to undercut the wholesale business for short-term gains will piss off retail partners, damaging the crucial relationships a brand needs to reach shoppers. Besides, customers don鈥檛 necessarily want to buy from a brand鈥檚 website. According to 2017 Census Bureau data, ecommerce accounted for just 10 percent of total retail sales. Rather than trying to pressure a potential consumer to buy online, argued Kristin Carpenter-Ogden, founder of Verde Brand Communications and host of its Channel Mastery podcast, it鈥檚 better to present all the options and make it easy for shoppers to choose their favorite.

Ultimately, internal catfighting actually harms sales. 鈥淏rands seem to have trouble juggling two balls at once鈥擺they think] either you鈥檙e successful in wholesale or you鈥檙e successful in direct,鈥� said Rich Hill, president of Grassroots Outdoor Alliance. 鈥淏ut across all our brands, the ones that are truly successful are successful in both. Overall, the brands that are taking this either/or approach are failing, not growing.鈥�

The root of the problem lies in brand organization and leadership, argued Christian Gennerman, VP merchandising and strategy at the 180 Commerce consulting firm. 鈥淭he biggest mistake is having someone overseeing their wholesale business and someone else overseeing their DTC business,鈥� he said. 鈥淓ach person in charge of that silo is bonused based on the [sales] they create in that channel. But they need to align goals at the highest level.鈥�

The Fix

Move away from compartmentalized units within the brand in favor of communication and teamwork. This is best done when a high-level employee makes it his/her job to oversee total business growth, not just an individual channel鈥檚 numbers.

Overall, brands need to abandon short-term, margins-based strategies for a more holistic, customer-centric approach. 鈥淵ou have to evolve so that you鈥檙e thinking more about the customer experience than you are about having one channel win over the other,鈥� noted Carpenter-Ogden.

The Strategy

Squashing channel conflict involves enhancing communication and shaking things up internally.

>> Appoint a 鈥淔ork鈥� 鈥淲hen I look across brands that have a true multichannel strategy, all of the sales channels report to a single individual,鈥� Hill said. 鈥淲e lovingly call this person 鈥榯he Fork.鈥欌€� The Fork鈥檚 job is to help manage internal policies and investments for big-picture success, growing the entire business rather than just one slice of it. 鈥淲here the Fork doesn鈥檛 exist, I鈥檝e seen a battle for messaging, for resources, and for inventory. Those are the brands we see suffer in wholesale and direct.鈥�

>> Change the bonus policy When bonuses depend on each segmented channel鈥檚 success, employees in those channels can get cutthroat. Instead, reward people based on the entire company鈥檚 success.

>> Get in the same room The heads of DTC, wholesale, online retailers, and any other distribution channels should meet regularly to talk strategy and messaging.

>> Talk early and often Avoid surprises between channels. It鈥檚 best for the DTC channel to stick closely to the brand鈥檚 MAP policy, said Gennerman. But if it must discount product, 鈥淭here must be continuous communication between brands and retail partners. Say, 鈥榃e鈥檙e going off-price early, but we鈥檙e not going for X amount of time because we want you to have first action on this.鈥欌€�

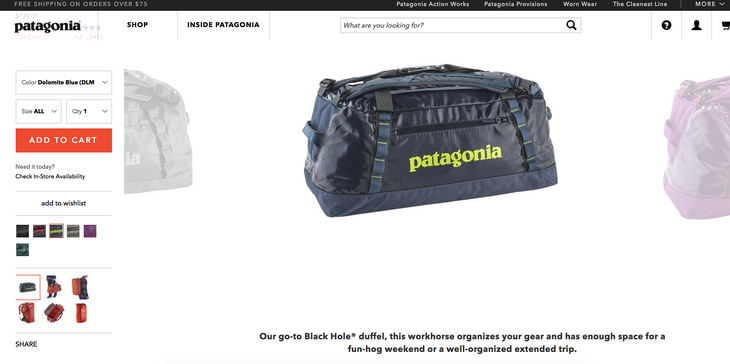

Case Study: Patagonia

At Patagonia, keeping channel conflict in check comes down to one clear, overarching vision for the company, said VP of Wholesale Bruce Old: 鈥淵ou can鈥檛 tell a customer where to shop. The big piece here is what the customer wants out of the [shopping] experience. Whether they walk into one of our dealers or one of our company stores, or [visits] a dealer website or Patagonia.com, we want to make sure the experience is really good across all those channels.鈥�

To hit that goal, the brand created their internal 鈥渙mnichannel team鈥� five years ago, and the leaders in all distribution channels meet monthly to hammer out strategy and keep the playing field level. One benefit: it allows channels to help, not hinder, each other. 鈥淭he omnichannel team is data-driven, and we make sure that we share trends with our retailers,鈥� Old said. For example, the team recently crunched the numbers from direct sales of Patagonia鈥檚 Black Hole luggage and passed them on to shops. 鈥淲e try to say, 鈥楬ey, listen, we鈥檙e seeing buying in our direct channels increase by X amount, and they鈥檙e colors you, as a retailer, aren鈥檛 buying.鈥欌€�

The team also gives retailers a direct voice with the brand鈥檚 higher-ups. After production issues forced Patagonia to drop a key product last fall, coupled with changes to the marketing calendar, it was left with messaging more focused on the direct business. 鈥淎 lot of retailers called us out on it, and they were right,鈥� Old said, adding that the brand has improved its coordination across the company as a result. And starting with Fall 2018, Patagonia shifted its seasonal buying and shipping schedules by 30 days to give retailers more time to order鈥攁 request communicated through omnichannel team meetings.

鈥淲e look at it from the perspective of, 鈥楬ow do we leverage the needs across all our channels for the greater good of the customer?鈥欌€� Old said. 鈥淣ot, 鈥楬ow is one channel going to meet their number versus another channel?鈥欌€�

The post The Outdoor Brand Playbook, Part 2: Managing Channel Conflict appeared first on 国产吃瓜黑料 Online.

]]>

Is it possible to get a better customer experience on a website than in a shop? Backcountry.com says yes

The post How Backcountry.com Plans to Surpass the In-Store Retail Experience appeared first on 国产吃瓜黑料 Online.

]]>

Backcountry.com isn’t just an e-commerce site. Sure, you can browse the website, full of a massive variety of product choices. But unlike other websites (and even many brick-and-mortar shops), you can also get access to a personal shopper who will help you find exactly what you need.

It’s a pretty novel concept for the internet. We asked Chris Purkey, VP of Backcountry’s Gearheads program, what customers can expect and why this concept has taken off.

What does the experience look like for a customer? How do you connect with a Gearhead, and what can he or she do for you?

A Gearhead鈥檚 primary mission is to inspire and enable people to get outside with confidence, and to have their greatest moments outside. Whether you鈥檙e new to an activity or a seasoned veteran, any experience with a Gearhead will share a few important commonalities:

First, Gearheads have learned through experience and offer expert guidance and collaboration. They love to share their perspective on gear, apparel, and local knowledge.

Second, working with a Gearhead is always a personal experience. They will invest in building a genuine and authentic relationship by understanding and supporting your needs.

Third, Gearheads come from all over the country. They embody outdoor culture and love sharing their own journeys and local experiences with you, the outdoor community.

Backcountry.com recently launched a new campaign, “Chase your GOAT,” or “Greatest of All Time,” to inspire people to set out in search of the best possible outdoor experiences.

Are Gearheads intended to replicate the experience you’d have in a retail shop?听

On the contrary, we believe that brick and mortar retail has not kept up with the consumer expectations. Most store experiences are inconvenient and the relationship is heavily transactional at best. Once there, the shop assistant may or may not know about the product or the activity the product is used for, and often times they鈥檙e not motivated or inclined to understand the customer beyond the immediate sale. There is a growing disconnect between the help and engagement that the customer desires and the service offering that is available elsewhere.

We also believe that shopping online in has become equally overwhelming. The paralysis of choice with marketplace retailers can be too much. Online research is often time-consuming, complex, discouraging and customers find it difficult to navigate to the right product easily. Combine this with countless levels of technical understanding and a tendency for online brands to scream promotion, and customers feel disorientated in a sea of sameness.

What do customers think of this experience?

Backcountry.com was built on product excellence and service. The business is known and trusted for the great products it carries and the credibility it has earned for serving its customers well. It is, however, time to build on that foundation and extend the benefit the business provides its customers by being true partners, in every sense of the word, as they seek out new outdoor experiences in life.