My college girlfriend and I used to love to walk to the local Blockbuster and peruse the shelves. We would ghost along the middle aisles of aged videos, our feet shuffling along the thin blue carpet, and occasionally lift a box for the other to reject with a noncommittal shrug. Now, of course, we peruse online, and Blockbuster has been reduced to a , a last , and a blast of nostalgia for people like me.

When we want to buy a bike, however, we still go through a similar ritual: we go to a local shop and wander the aisles. But recent shifts in sales and business models are changing the way that we buy bikes, and some shop owners are worried that if things don't change, they could become a relic, too.

The clouds have been gathering over the independent bike shop for some time. According to the National Bicycle Dealers Association, there’s been a 42 percent decline in bike shops since the industry’s height in 2001, when a population injected with Armstrong enthusiasm stormed shops across the United States, demanding carbon fiber and spandex.

Although a general increase in store size has allowed overall revenue to stay relatively constant, and every city with a healthy bike scene can point to a shop that’s thriving, this trend does not bode well. So any change in the purchasing habits of consumers looking for a new ride can cause the industry to look furtively upward.

And the storm building over their heads looks a lot like Canyon Bicycles, which is set to enter the U.S. market next year.

You may have seen the diminutive Colombian bullet, Nairo Quintana, win the Vuelta a España on a Canyon. You might have salivated over of the company’s MTB line. Over the past decade, the German manufacturer has been increasing market share in Europe, growing roughly 30 percent each year and claiming nearly $180 million in revenue for 2015. What worries independent retailers is that Canyon did it entirely through direct-to-your-door online sales. Bypassing the local shop means Canyon is able to sell its bikes at a steep discount compared to prices at Joe’s Wheels and Deals. For many, the convenience and savings of purchasing online outweighs the benefits of test rides and a free tune-up.

Until now, bike shops have been somewhat insulated from the impact of e-retail, largely because a typical shop earns nearly half its revenue from sales of complete bikes, and manufacturers have heavily committed themselves to selling through bike shops and keeping their bikes out of digital shopping carts. But recently, in response to Canyon and the pressure to adapt to a changing sales model, both and introduced online sales.

The storm building over their heads looks a lot like Canyon Bicycles, which is set to enter the U.S. market next year.

This is big news that has seriously worried the shops that rely on these brands. To allay their concerns, both manufacturers have doubled down on their relationships with stores that carry their product. “I appreciate the bind these manufacturers are in,” says Erik Tonkin, owner of Sellwood Cycle Repair in Portland. “They’re trying to do the right thing, but they’re having to acknowledge market forces. But they also don’t want to piss off their brick-and-mortar network, so they’re trying to thread the needle.”

Say you want a new Giant or Trek, but the closest shop to you is across town and you really don’t want to put on pants. So you hop online. You know your size, and purchasing is as easy as choosing the model you want. Click, pay, done. Almost. You still have to put on pants eventually, because rather than showing up at your doorstep, the manufacturer shipped your new 15-pound rocket to your local dealer. The shop builds the bike, shakes your hand, and throws in that free tune-up. You get convenience, and the shop gets close to the same revenue as if the bike had been in stock. For the consumer, that means there's no discount for bikes purchased online: instead, she's getting the benefit of convenience and a broader selection of models.

That all speaks to the potential for positive symbiosis. If online sales increase, shops need to carry less inventory, thus lowering their overhead and credit debt to manufacturers. Consumers still get the shop experience that Giant and Trek hope will keep cyclists loyal to their product. Shops further pivot toward the service-over-sales model that builds a relationship with their community, and passers-by still glimpse their dream bikes through store windows. “I don’t think it’s a bad thing,” says Tonkin. “It’s reality. Whichever company does this the best might just get more brick-and-mortar sales out of this.”

But there are a few issues.

Problem one: the online-to-shop model must respect MSRP and the margins necessary for a shop to keep its doors open. If models like Canyon catch on, Trek and Giant can’t hope to price match without cutting out your local shop. Sure, consumers may decide they value shop and brand loyalty over price, but that’s pretty soft ground to build a house on. Just ask defunct bookstore Borders.

Problem two: because of their long avoidance of internet sales, these companies have potentially already drilled into the hulls of their brick-and-mortar ships. Until recently, big manufacturers had responded to the internet with a kind of retail land grab, maneuvering to dominate entire stores rather than share space with competitors. Instead of basing wholesale prices on the number of bikes ordered, brands began basing them on what percentage of a shop’s inventory that particular brand represents. If, say, 60 percent of your stock is a single brand, you get one price. If it’s 80 percent, you get a much bigger discount. The required percentage has crept higher every year. These days, the very best deals don’t kick in until shops devote 95 percent of their inventory to one brand. With margins as thin as they are, the incentive to essentially become a showroom for a single brand is significant. This system, combined with shops purchasing on credit, nearly buried independent retailers in 2015.

“Most manufacturers rolled back commitments because last year was so bad,” says another shop owner in Portland, Oregon who asked not to be named. “The industry is unhealthy and everybody we deal with didn't front load us this year. The shops that are still getting front loaded won't be here for long.”

This means your middle-tier manufacturers, like Santa Cruz and Yeti, which have been pushed out of the storefront by the big three, have a huge incentive to jump on the direct-to-consumer model. They haven't done so yet, but if Canyon is successful in the U.S., brands like Yeti and Santa Cruz will likely follow suit quickly. As more manufacturers bypass shops altogether and sell at online-competitive prices, consumers’ sense of “what a bike costs” will lower, and shops will have difficulty competing.

“Sell your shop now, or enter the demise of all brick and mortars,” says Mike Romanco, CEO at Mike’s E-Bikes, in response to Trek’s online sales program. “You’d be better off working out of your home and just having a delivery van.”

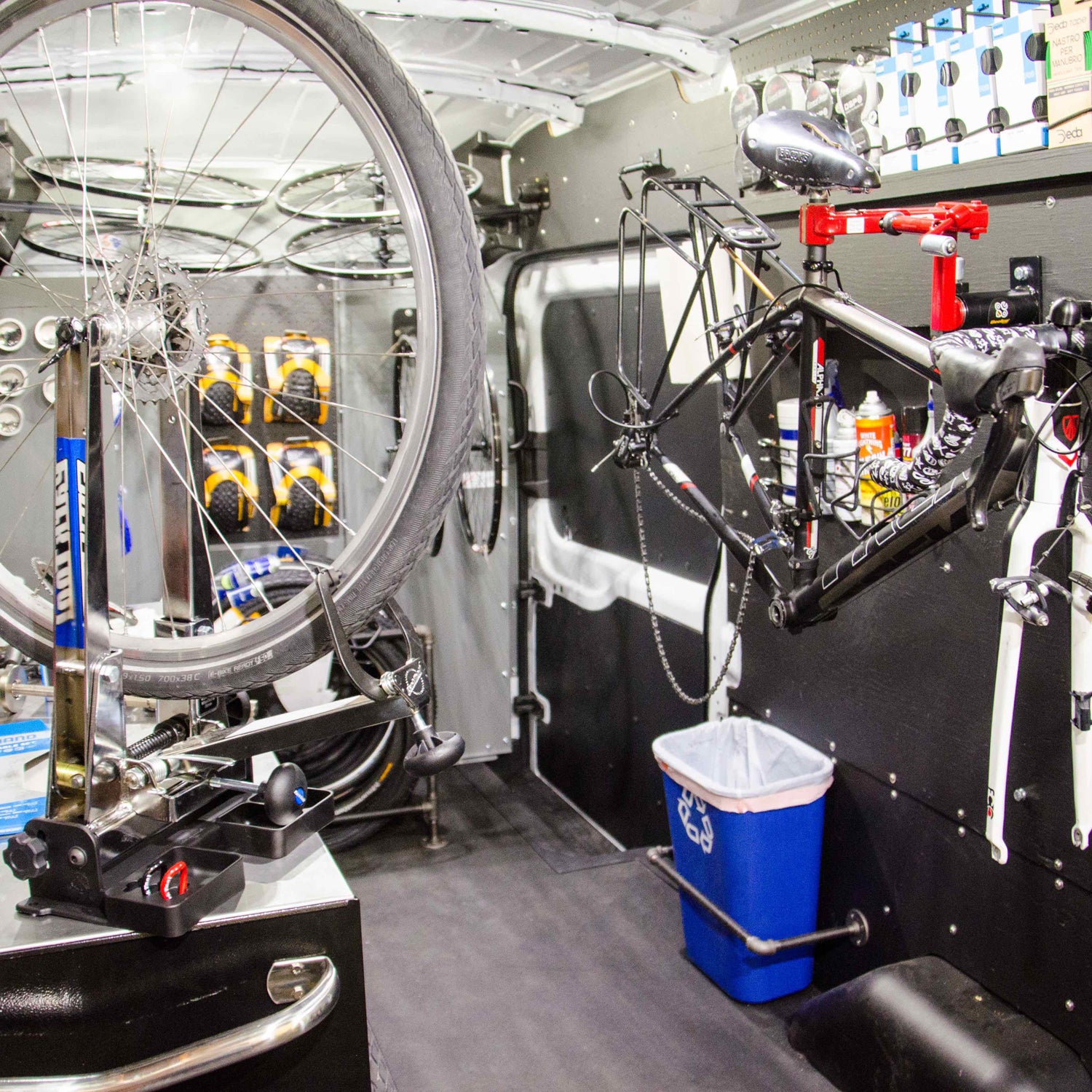

Which, funny enough, is exactly what’s happening. From the swell of increased online sales and sidelined brands, the mobile mechanic has emerged, riding the wave of change in a tool-filled Sprinter.

Beeline Bikes and Velofix are at the forefront of this model, providing a certified mechanic and full-service shop in a van, which comes right to your door, so Dad can continue pulling raisins out of his kid’s nose instead of schlepping a flat Schwinn to the shop. With minimal overhead and a franchise model, both businesses are growing rapidly. So rapidly, in fact, that Beeline Bikes has now , owner of Raleigh and Redline, to build and deliver their bikes—purchased online—direct to your door. Imagine what will happen if they install an espresso machine.

Will we, a few years from now, reminisce about the smell of new tires and the sound of an air compressor burping from the repair section? Will we chat with the mobile mechanic about how we used to pull down the most expensive bike in the shop and feel, even for just a fleeting moment, what it would be like to own such a steed?

Here's the bottom line: to keep local retailers around, we're going to have to forget about price and instead put a premium on experience. The question is: Will we?