Everyone in this industry knows the problem by now: the rise of online shopping has turned the traditional outdoor marketplace on its head. Consumers now turn to the internet first when they need new gear; brands seize the chance to sell it directly through their own websites or on Amazon; brick-and-mortar retailers are left scrambling Less obvious? The solutions. OBJ has partnered with Mike Massey, founder of the online marketing platform Locally (which makes it easier for brands to refer buyers to nearby retailers for the sale), to examine how brands and specialty retailers can work together to everyone’s benefit. Over the next few months, we’ll examine several key principles for making the brand-retailer relationship even stronger in this brave new world.

We may not like it so much when we’re talking about a kid who refuses to eat his peas, but being picky is a crucial trait in the outdoor gear business. Stocking anything and everything is the mass-market stores’ game. Specialty retailers, on the other hand, will live and die on a more curated approach—and vendors who are choosy about their distributors will reap benefits, too.

Why Curation Matters

Selectiveness begins with a store’s inventory, argues Mike Massey. “If you decide as a retailer to just carry the top 40 items based on NPD or SportsOneSource data, you’ll rapidly find that Dick’s Sporting Goods and Academy Sports and Amazon are looking at the same lists and carrying the same products,” he said. Brick-and-mortar shops can shine by doing the opposite: sniffing out innovative new brands and products that customers don’t even know to search for online.

And beyond the products themselves, retailers should also be selective about how and where a potential vendor does business. A company that also distributes through the big-box giants won’t help a store cultivate a unique feel, and one that offers its gear at steep discounts online can prove a troublesome partner for specialty retailers struggling to maintain their margins.

The Walmart Effect

Vendors also benefit from some pickiness about distribution channels. For one, opting to work with a behemoth like Amazon adds costs in the form of fees, and selling through hard-to-police third-party channels can lead to problems when they don’t follow a brand’s pricing policies.

But perhaps even more importantly, distributing too freely, with too many cheapest-is-best outlets, eats away at a brand’s image for making premium gear: “It’s the Walmart effect,” Massey said, noting that distributing through discount channels leads to the “commoditization” of products, stripping value from the gear.

What’s more, curating the right specialty retail partners can do a lot more for a brand than get its gear on more shelves. “A lot of brands are in a weird place right now where they don’t seem to understand the importance of influential retailers in a local market,” Massey said.

For example, at Half-Moon Outfitters, a nine-store chain in Georgia and South Carolina, the shops aim to amplify a brand’s story through well-informed employees, incorporate vendors into popular store events, and share customer data with partners. “Hopefully, that saves the vendor from having to do its own outreach in our markets,” noted founder and owner Beezer Molton. “We’re doing it better than they ever could, given that they’re not located where we are.”

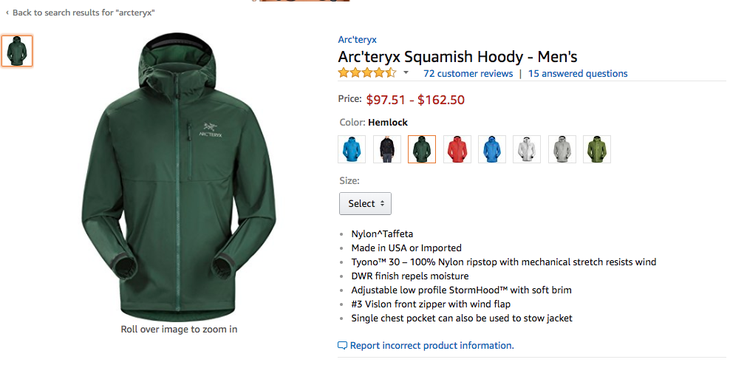

And cozying up to a beloved local shop can boost a vendor’s reputation. “Somebody like [Colorado’s] Bent Gate Mountaineering has connections to their customers—they rely on them for expertise,” said CJ King, Arc’teryx’s global commercial vice president. “When our brand is associated with a retailer, and someone walks in and has a good experience in the store, there’s a positive impact on our brand to be in those retailers, whether the customer walks out with an Arc’teryx jacket or not.”

Successful Curation Stories

The buyers at Half-Moon Outfitters approach curation with a combination of art and science. The art comes through searching out unconventional new gear and brands: “We would periodically weave in some weird New York fashion stuff, or early versions of the lumbersexual thing,” Molton said. “We’ve always been open to brands from all over. What it comes down to is, how good is their story relative to adventure and travel?” He cites Howler Brothers, Stance, Sunski Sunglasses, and OluKai as recent favorite finds.

And the science? After every encounter with a brand, Half-Moon’s team of five buyers updates an “elaborate” spreadsheet that tracks everything from distribution decisions (whether the brand sells on Amazon, through third-party sellers, and/or direct to consumer) to retailer support practices (like providing money for advertising, enforcing discount blackout dates during prime selling season, and guaranteeing sell-through on some products).

“The [vendors] who are steering away from the commoditization of our industry—those are the guys we’re going to support,” Molton said. “They either need to just not be on Amazon, Zappos, or Walmart at all, or, if they choose to do business there, they have to observe MAP [minimum advertised price] policies in their most stringent sense. We measure it very carefully for every vendor.”

Such thoughtful curation is key to retail success moving forward, he added: “When you look at the Wall Street Journal, you can get a little depressed about retail in this country. However, the truth is if it’s quality retail, you’re telling a great story, and you have great brands to foster and encourage, it becomes a wonderful experience and a very clear path forward.”

On the brand side, Arc’teryx sticks to a tight distribution strategy to help maintain its top-of-the-line reputation. “We’re looking for retailers that can tell the Arc’teryx story along with their own story in an impactful way,” King said. “We’ve spent decades training our specialty retail staff, spending time with employees and trying to present assortments so they can tell our story. The wider your distribution gets, the harder it is to manage everything that’s going on.”

“Independent retailers are at the bottom of the food chain,” said Dave Polivy, owner of Tahoe Mountain Sports in Truckee, California. “It’s really the vendor’s choice about how they’re going to handle their Amazon business, whether they’re going to deal with Amazon directly, and whether they’re going to consistently enforce their MAP [minimum advertised pricing] policies. Those are the things that we should be fighting for as specialty retailers.”

It’s worth noting that strategy includes a place for ecommerce through a select group of third-party sellers on the Amazon Marketplace. “Amazon is a necessary point of distribution,” King noted. “More than half of the searches for product start there, at least in North America. It’s important for brands to be there. As long as we maintain our brand image on the product detail pages, it can still be a good shopping experience.” Arc’teryx went with third-party sellers rather than working directly with Amazon because that method helps them maintain better control over pricing, he said.

Do Curation Better

Here’s how retailers and brands can use pickiness to their advantage.

>> Give ‘em a reason to come in Introducing customers to unique brands and products should be a significant part of any specialty retailer’s business. “At Massey’s Outfitters, we walk trade shows and try to get to the outer limits, out in the tents, and find brands like Cotopaxi or Katin,” Massey said. Adds Molton, “Bringing the freshest, coolest thing in protects the notion of shopping as an activity and maintains that specialty experience—which is unattainable looking at a screen.”

>> Choose retail partners carefully In short, vendors should seek out stores that will make them look good—whether that means a top-notch sales force, opportunities to get involved with community events, or strict pricing policies. “What does the presentation look like?” King asked. “Who’s the floor staff, and what expertise do they provide? Is this the type of place we want our brand to be associated with? The places we struggle with are the ones that want to be transactional, where price is an issue and brands go on sale a lot.”

Next up: How community events build a retailer’s influence and grow customer loyalty.