Successfully producing outdoor gear used to be such a simple endeavor: make great product, then sell it through retail partners, or directly through a catalog or your own store. These days, the formula has become a lot more complicated. With the option to distribute through a suite of channels—specialty retailers, big-box retailers, directly to consumers via ecommerce and/or your own storefronts, through Amazon’s vendor central or Amazon resellers—brands must pull off a delicate balancing act and juggle a network of relationships to get their gear into customers’ hands. The good news? This swirl of channels also presents an opportunity to reach consumers wherever they are, telling a vibrant brand story while enhancing the shopping experience like never before. Over the next few weeks, OBJ’s special series The Outdoor Brand Playbook will take a closer look at best practices for vendors in an increasingly omnichannel world.

The Challenge: Cultivating the Right Specialty Dealer Network

Consider the many types of stores that sell gear: the beloved local institution. The sporting goods big-box. The hyperspecialized paddling or skiing shop. The large-scale outdoor chain. Then consider all of the individual businesses within each of those categories, in marketplaces across the country. Brick-and-mortar options abound for reaching outdoor consumers—so where, exactly, should any given brand sell?

As appealing as the pure volume of an “all of the above” distribution strategy might sound, there are reasons to be more discriminating. For one, a more calibrated approach can ultimately prove more efficient for vendors, argued Kristin Carpenter-Ogden, founder of Verde Brand Communications and host of its Channel Mastery podcast. “It’s about a brand and a retailer sharing a target end consumer,” she said. “Everything we do today should be surgical in how we’re serving that avatar.” A brand’s most likely customers probably shop in specific kinds of stores: find which ones, and get a direct line to their wallets.

Then there’s the way that partnering with a particular type of dealer might affect brand image. Being on the shelves of a trusted gear shop with knowledgeable, passionate employees tends to reflect positively on a vendor. But on the flip side—like it or not—selling through discount chains such as Walmart or Sierra Trading Post, or non-outdoor outlets such as convenience or department stores, can damage a vendor’s high-end reputation. “Brand enthusiasm is built on one-to-one personal interactions,” said Mike Massey, founder of Locally and owner of Massey’s Outfitters. “When brands take the low road on distribution, they are allowing certain types of retailers to burn off their goodwill.”

That sort of reputation damage can in turn spook the influential specialty retailers brands should be seeking out in the first place, pointed out Christian Gennerman, VP marketing and strategy at 180 Commerce. “As brands open up stores looking for growth, they sometimes push the boundaries of their brand for the sale,” he said. “This has detrimental effects on their existing relationships with partners.”

“Great brands are being squeezed out of specialty because of decisions to expand their markets,” agreed Garth Evans, sales director at Big Agnes (see below). “In a fairly short period of time, because of their distribution decisions, they aren’t considered premium brands at specialty anymore. Specialty retailers, for the most part, would rather work with specialty brands.”

Massey put it more bluntly: “[Brands that are] making boxes of product that destroy goodwill—specialty stores fire those brands and pick up their competitors.”

The Fix

Find the retail partners that will create the best environment for attracting target consumers and telling a brand’s story. Look for dealers that see eye to eye on matters both practical (merchandising, customer service, discounting) and big picture (company values).

The Strategy

Building the ideal retailer network requires on-the-ground research and thoughtful communication.

>> Lean on local reps “You have to find a great sales rep and trust his or her opinion,” said Rich Hill, president of Grassroots Outdoor Alliance. “Reps are the experts.” A local sales rep who knows the territory inside and out will help immensely in pinpointing the best dealer-vendor connections.

>> Scope out the inventory Make sure your product fits in with everything else a store stocks in terms of quality and price. “Our conversation is, ‘Let’s look at your current assortment,” said Evans. Red flag: the other comparable products cost half as much as your gear. “It doesn’t do either of us any good to put in product that will collect dust,” said Evans.

>> Grow thoughtfully… Stores understand brands wanting to expand within their local marketplaces—but opening up a new store across town without warning can harm existing relationships. “If brands are expanding their distribution, [they should be] informing the market before the preseason order deadline,” said Hill. “As stores write their preorders, they need to know what the market looks like. It’s about operating with forethought and integrity for long-term success.” For example, noted Evans, current retailers might choose to order more from another vendor knowing that there’s a new Big Agnes dealer in town.

>> …and shrink thoughtfully, too Cleaning up distribution by ending some retailer partnerships can be smart strategy, but vendors would do well to communicate those decisions with tact. For example, Yeti ruffled some feathers earlier this spring when it terminated dealer relationships with a form letter.

Case Study: Big Agnes

Colorado indie brand Big Agnes looks at distribution policy through a five-year lens, said Sales Director Garth Evans: Will a given decision keep Big Agnes in its position as a specialty vendor serving the specialty market five years down the road? “That’s different from ownership saying, ‘Prepare us for sale,” ‘Prepare us for investment,” different from ‘We want to go broad-base, making different price points and less technical product,’” he said.

Evans’s top priority: “We like the specialty, service-oriented stores that have the ability to get our product in front of the technical consumer—and can speak intelligently about product,” adding that he relies heavily on the brand’s sales rep force to sniff out these ideal stores.

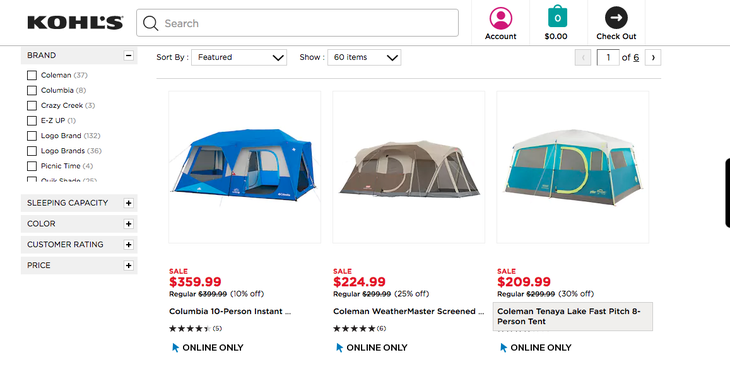

One of Big Agnes’s major distribution challenges is managing growth while maintaining these criteria, Evans said. And the brand has had its ups and downs. For example, Big Agnes joined up with the department store Kohl’s when it launched an online camping business in 2013. “The ramifications were immediate in terms of the existing dealer base asking us what we were doing,” Evans said, citing the retailers’ concerns about the move devaluing Big Agnes with customers. “They asked, ‘Is this an indication of the direction you’re taking the brand?’” Big Agnes discontinued the partnership later that year: “That lesson demonstrated that selling everywhere isn’t the right policy,” he said.

But the brand has also found success in growing outside of the traditional specialty retail marketplace. “We’ll stretch a little on the outside markets,” Evans said. “If stores focus more on the hunting, fishing, or paddling side of the market, we may be open to a bigger format because they reach a customer we don’t typically market toward, but can benefit from our product.” Evans notes that Big Agnes has seen sales growth in the high double digits for these adjacent markets since moving into them beginning in 2013, compared with low double-digit growth in the outdoor market for the same period.

And so far, this extended approach to distribution has been paying off without harming current dealer partnerships, largely because of limited consumer crossover and the tendency for different markets to focus on different parts of the Big Agnes line.